Indian Oil and Gas Canada (IOGC) Annual Report 2018-2019

PDF Version (807 Kb, 43 pages)

Table of contents

- Message from the CEO

- Overview

- Strategic Priorities – FY2018-2019

- Key Project #1 – Indian Oil and Gas Act, 2009 (IOGA, 2009) and Phase I Regulations Implementation

- Key Project #2 – Resource Information Management System 2 (RIMS2)

- Results Achieved in FY2018-2019:

- Key Project #3 – Phase II Regulations Development

- Operations

- Special Subject: Province of Alberta's Announced Crude Oil Production Curtailment

- Special Subject: Band-Owned Oil and Gas Companies

- Oil Production from First Nations Lands

- Oil Prices

- Natural Gas Production from First Nations Lands

- Natural Gas Prices

- 4. Planning and Corporate Services Directorate

- Revenues Collected on Behalf of First Nations

- Human Resources at IOGC

- IT – Resource Information Management System 1

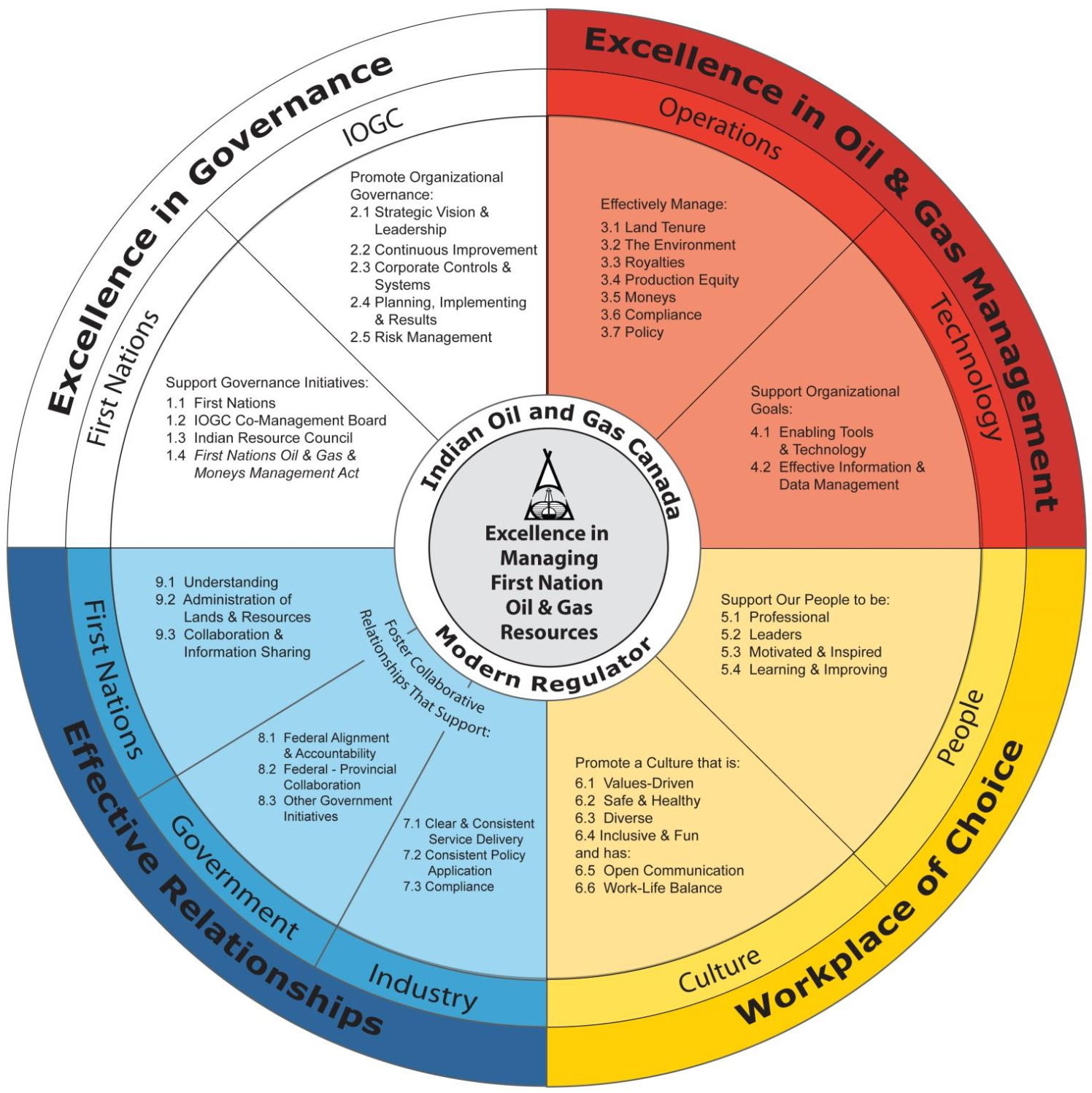

- IOGC Strategic Framework

- Excellence in managing First Nation oil and gas resources

- Excellence in Governance

- Excellence in Oil & Gas Management

- Workplace of Choice

- Effective Relationships

- Financial Operations FY2018-19

- Glossary of Acronyms

Message from the CEO

To our First Nations’ clients and industry stakeholders

In addition to Indian Oil and Gas Canada’s (IOGC) ongoing day-to-day operations, the Modern Act, Regulations and Systems (MARS) project was a key activity and organizational priority in Fiscal Year 2018-2019 (FY2018-19). The MARS project is comprised of three inter-related sub-projects with the following milestones targeted for completion during this reporting period:

- Completing the gazetting and approvals processes for the Phase I or "Core" regulations, then bringing both the Indian Oil and Gas Act, 2009 (IOGA, 2009) and the Phase I regulations into force, and finally implementing and administering both the IOGA, 2009 and the Phase I regulations beginning on the day both become law;

- Continuing the Resource Information Management System 2 (RIMS2) systems development project, having secured both project and expenditure approvals in May 2016; and,

- Continuing the development of the Phase II regulations in consultation with First Nations, industry, and provinces.

The MARS project was initiated in FY2010-2011 to guide the modernization of the Indian Oil and Gas Regulations, 1995 and the implementation of the 2009 Act and its new regulations. The first milestone enabling the MARS project was achieved once amendments to the Indian Oil and Gas Act received Royal Assent in May 2009. This resulted in a new Indian Oil and Gas Act, 2009 that will eventually replace the existing Indian Oil and Gas Act, 1974. Yet the 2009 Act could not be brought into force until new regulations, enabled under that statute, had been completed so as to provide a complete framework for regulating oil and gas activity on First Nations lands.

A Joint Technical Committee (JTC) – comprised of First Nation oil and gas technicians, Government of Canada officials from IOGC, Crown-Indigenous Relations and Northern Affairs Canada, and Justice Canada – worked on both the Indian Oil and Gas Act, 2009 and have since focused on the development of its supporting regulations. The Indian Resource Council (IRC) – an Indigenous organization that advocates on behalf of some 189 member First Nations with oil and gas, or the potential for such resources – provides oversight and direction for First Nation participants of the JTC. The IRC and JTC assists IOGC by facilitating First Nations’ awareness of the changes and the impacts to how future oil and gas operations will be conducted on First Nations lands.

An agreement reached in 2014 between the department and oil and gas-producing First Nations established a phased, or staggered, approach for regulatory development. First, the 2009 Act plus a set of Phase I, or Core, regulations would become law. Next, regulations would continue to be developed and implemented until the existing Indian Oil and Gas Regulations, 1995 have been entirely replaced by new, modern regulations. IOGC’s new legislative and regulatory regime will be implemented by modernized business practices, supported by new or enhanced information systems.

During FY2018-2019, two significant milestones were reached on the MARS project. Firstly, official, or Blue-Stamped, Draft Phase I regulations were approved by Treasury Board and pre-published in the Canada Gazette, Part I, and simultaneously in the First Nations Gazette, on May 18, 2018 for a 90-day public review and comment period that ended August 17, 2018. Commitments made to oil and gas-producing First Nations, as well as public feedback, were considered and evaluated and included in the Final Phase I regulations, where appropriate. By the end of FY2018-2019, the official, or Blue-Stamped, Final Phase I regulations were almost completed by Justice Canada. It is projected that these Final Phase I regulations will undergo the required departmental approvals processes leading to their consideration by Treasury Board for publication in the Canada Gazette, Part II early in FY2019-2020. At the same time, and on a parallel course, an Order-in-Council will be prepared so as to bring into force the 2009 Act on the same day as the Final Phase I regulations.

A second significant milestone was achieved on the Royalty Management component of the RIMS2 Project when functionality for managing Gas Cost Allowance was deployed and implemented in February 2019. Gas Cost Allowance calculation is one important component of Royalty Management. The RIMS2 project is composed of three major components: 1) Petrinex data exchange with IOGC; 2) new Royalty Management functionality; and, 3) the introduction or piloting of Case Management at IOGC. Once fully implemented, the RIMS2 project will provide two important benefits:1) avoiding potential disagreements between First Nations and their industry partners, namely in volume measurement and pricing; and, 2) improving both the accuracy and timeliness of IOGC’s royalty assessment process.

On the operations side, world oil prices have steadied but persistent, weak natural gas prices (natural gas prices are stronger during colder months) in Canada have resulted in: 1) a movement away from the development of dry gas playsasterisk* to oil plays and liquids-rich gas plays; 2) fewer wells being drilled; and, 3) a reduction of the number of drilling rigs and service rigs operating in Western Canada. A significant number of rigs have been migrated to the United States where drilling, production, and infrastructure development have increased. In FY2018-2019, IOGC collected $55,045,200 on behalf of First Nations while a total of 33 new surface agreements and 3 subsurface agreements were issued. In addition, $61.9 million was invested by industry to drill and complete 26 wells on First Nations lands. Greater details on IOGC’s operational activities are contained within this report.

The project milestones and operational successes over the past year would not have been possible without the dedication and contributions of IOGC’s staff, our First Nation clients, and our partners. Through hard work, effective partnerships, and perseverance, IOGC continues to build a strong foundation for continuing to be a modern regulator of oil and gas activity on First Nations lands.

Sincerely,

Strater Crowfoot

Executive Director and CEO

Return to asterisk* referrer A play is a region with oil and gas exploration or development prospects.

Overview

History of Indian Oil and Gas Canada and the Legal Authorities Under Which It Operates

The Government of Canada has a broad mandate for First Nation issues, which arises from existing legislation and from legal obligations contained in section 91(24) of the Constitution Act, 1867. Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC)Footnote1is entrusted with fulfilling various obligations of the federal government to Indigenous people as outlined in the Constitution, treaties, the Indian Act, and other legislation. Included in this obligation is the management of natural resources on First Nations lands, including oil and gas.

Oil and gas development on First Nations lands has been legislated since 1974 under the Indian Oil and Gas Act, 1974. Prior to that, oil and gas activities were administered under the Indian Act. In 1977, the Indian Oil and Gas Regulations were promulgated and brought under the Indian Oil and Gas Act, 1974. Those regulations were last revised in 1995.

In 1987, Indian Oil and Gas Canada (IOGC) was established and replaced Indian Minerals West within the Department of Indian Affairs and Northern DevelopmentFootnote1. IOGC’s mandates are to manage oil and gas development on First Nations lands and to further First Nation initiatives to manage and control their resources. In 1993, IOGC became a Special Operating Agency to increase its client focus. IOGC reports to CIRNAC via the Assistant Deputy Minister of Lands and Economic Development.

Statutory Authorities

IOGC operates in accordance with provisions of the Indian Oil and Gas Act, 1974 and the Indian Oil and Gas Regulations, 1995.

IOGC also operates in accordance with other federal legislation including provisions of the Indian Act, the Canadian Environmental Assessment Act, 2012Footnote2, and the Financial Administration Act.

IOGC Co-Management Board

IOGC operates under the direction of an Executive Director and Chief Executive Officer (CEO) who participates as a member of the IOGC Co-Management Board. The Board was established in 1996 by the signing of a Memorandum of Understanding between the Minister of Indian Affairs and Northern Development and the Indian Resource Council (IRC – an Indigenous organization that advocates on behalf of approximately 189 member First Nations with oil and gas or the potential for such resources). The Board focuses on areas of common interest.

There are nine members on the IOGC Co-Management Board. The Board is comprised of the IRC Chair and five other members nominated by the IRC. Two positions are named government official positions: the Assistant Deputy Minister of Lands and Economic Development; and, the Executive Director and CEO of IOGC. One position is appointed by the Minister from the oil and gas industry.

Roles and Responsibilities

IOGC is a Special Operating Agency and separate employer within Crown-Indigenous Relations and Northern Affairs Canada with responsibility for managing and regulating oil and gas resources on designatedFootnote3First Nations lands across Canada.

Over 500 reserves have lands designated, pursuant to the Indian Act, for oil and gas development. At present, 194 companies have active oil and gas agreements on First Nations lands. IOGC currently manages the oil and gas resources of 57 First Nations (108 reserves) with active oil and gas agreements. All funds collected on behalf of First Nations are placed in their trust accounts.

IOGC works closely with First Nation Chiefs and Councils through the negotiation and approval processes. All agreements require Chief and Council approval through a band council resolution (BCR). For those First Nations who have designated their lands for oil and gas activities; IOGC’s main functions are to:

- Facilitate the negotiation and granting, and the ongoing administration of contracts among First Nations and oil and gas companies;

- Conduct environmental reviews and issue environmental protection measures;

- Monitor and verify oil and gas production and sales prices;

- Verify / assess and collect moneys such as bonuses, royalties, and rents;

- Lifecycle management, including well, pipeline and facility compliance monitoring throughout all phases as well as abandonments, remediation and reclamation; and,

- Ensure legislative and contract requirements are satisfied.

Strategic Priorities – FY2018-2019

The MARS (Modern Act, Regulations and Systems) project continued to be the organization’s top priority in FY2018-2019. The MARS project itself has three major component sub-projects:

- Indian Oil and Gas Act, 2009 (IOGA, 2009) and Phase I Regulations Implementation – The 2009 Act and its Phase I or "Core" regulations will provide the legislative and regulatory foundation for IOGC to continue to be a modern regulator. They are both projected to "come into force" (i.e., to become law) in FY2019-2020. To support their implementation, IOGC and its staff must be ready to begin administrating the new Act and regulations beginning on the first day they both become law. IOGC must also inform clients and stakeholders (First Nations and their organizations, provincial government, industry) about legislative, regulatory, operational, and technology changes.

- Resource Information Management System 2 (RIMS2) – Efficient and effective use of information technology (IT) supports government priorities and program delivery. Informatics enhancements will help IOGC address and support anticipated regulatory changes.

- Phase II Regulations Development – The continued active participation of IOGC, its First Nations clients, and key stakeholders in the regulations development process helps to ensure a modern legislative and regulatory regime that benefits First Nations.

Key Project #1 – Indian Oil and Gas Act, 2009 (IOGA, 2009) and Phase I Regulations Implementation

Since this has been a multi-year effort, it is important to provide some important historic background and context.

Background and Context:

a) Legislation Development – First Nations’ Involvement

Legislation modernizing the Indian Oil and Gas Act, 1974 received Royal Assent in May 2009 and resulted in the Indian Oil and Gas Act, 2009. The 2009 Act is not currently in force because regulations, authorized under that statute, need to be completed to provide a complete framework for managing oil and gas activity on First Nations lands. Once it becomes law, the 2009 Act will provide many benefits for First Nations as a result of new authorities provided for IOGC:

- to audit companies working on First Nations lands;

- to set longer periods for industry to maintain records for auditing purposes;

- to deal more effectively with surface and subsurface trespass;

- to protect First Nations sites of historical significance, or sites of cultural, spiritual, or ceremonial importance;

- to order companies to take remedial action under certain circumstances;

- to provide for the issuance of fines and penalties for offences under the Act or regulations;

- to add specificity on regulation-making authorities; and,

- to be accountable to Parliament, with reporting required every two years, on consultations and future variations in regulations from province to province.

The IOGA, 2009 provides for modernized regulations that would largely align with provincial regimes in key competitive areas. The resulting benefits would be: 1) industry working with rule sets that are familiar to them; and, 2) First Nations lands being as competitive for industry investment as equivalent lands in the surrounding province.

The IOGA, 2009 was developed with the assistance of the Indian Resource Council (IRC) along with the participation of a Joint Technical Committee (JTC) made up of: IOGC; Departmental and IRC officials; experienced First Nation oil and gas technicians; and, officials from other federal departments. Once their work on the 2009 Act was completed, the JTC focused their attention on the development of new regulations. First Nations were funded for their participation in the development of legislation and the funding provided allowed First Nations to obtain independent legal and technical advice.

To ensure that First Nations benefitted, with minimal delay, from the many improvements contained within the 2009 Act, in 2014 the Department proposed – with First Nations’ concurrence – a phased approach for developing regulations and bringing them into force. Under such an approach, the IOGA, 2009 will come into force simultaneously with a set of Phase I, or Core, Indian Oil and Gas Regulations; new regulations would continue to be developed and brought into force until the existing 1995 regulations have been entirely replaced by new, modern regulations.

b) Regulations Development – First Nations’ Involvement

The JTC is a working-level committee, comprised of First Nation and government members, appointed with the responsibility to review and comment on proposed changes to the existing Indian Oil and Gas Regulations, 1995. This group does not replace individual involvement sessions with First Nations but allows IOGC to access those First Nation technicians with significant oil and gas expertise. First Nations were funded for their participation in the development of regulations and the funding provided allowed First Nations to obtain independent legal and technical advice. Due to the expected complexity of the new regulations, the work was divided into a number of themes with each theme subsequently becoming a distinct regulatory module.

In early FY2015-2016, the work of the JTC resulted in the completion of the 2nd Consultation Draft, Phase I regulations – a version sufficiently complete and detailed that it could be widely circulated to all IOGC’s clients and stakeholders for review and feedback. Printed copies of the 2nd Consultation Draft, Phase I regulations were provided to First Nations, industry with active agreements on First Nations lands, and the oil and gas-producing provinces for their detailed review and input. Electronic versions of these documents were published on the First Nations Gazette website on May 12, 2015.

Stakeholder feedback received was grouped under three categories: 1) Technical; 2) First Nations’ governance; and, 3) First Nations’ consultation. Technical comments received were accommodated, where appropriate. For feedback related to First Nations’ governance or consultation, by the end of FY2015-2016, the Department began exploring options with oil and gas-producing First Nations to establish a negotiating table for the development and consideration of potential solutions.

c) Regulations Development – Consultation, Engagement and Outreach

Throughout regulations development, face-to-face consultation and outreach with individual First Nations, Tribal Councils, and Treaty Areas were conducted upon request. In addition to these in-person meetings, First Nations with oil and gas or the potential, as well as all companies with oil and gas interests on First Nations lands, receive a quarterly newsletter with progress reports on the MARS project. Proposed draft regulations were distributed three times as consultation drafts, in March 2014, in May 2015, and in September 2017 to different groups of IOGC’s clients and stakeholders. The 2nd Consultation Draft, Phase I regulations was distributed to all First Nations for their review and feedback in early FY2015-2016. Towards the end of FY2015-2016, a special, pre-Blue-Stamped version of the Phase I regulations was prepared and shared at two symposiums hosted by IOGC.

In November 2018, a total of 138 industry representatives attended two half-day sessions in Downtown Calgary at which IOGC subject matter experts made presentations and answered questions from industry stakeholders regarding the implementation of the 2009 Act and the Phase I regulations. Feedback and questions from industry were collected and subsequently published on IOGC’s Internet website. In addition, an article was published in the February 2019 edition of the "Negotiator" magazine (a publication by the Canadian Association of Petroleum Landmen) that also informed industry about the implementation of the 2009 Act and its Phase I regulations.

Consultations on the Act and regulations have been among the most comprehensive ever conducted by the Department. Overall, IOGC engaged more than 250 stakeholders in over 80 one-on-one meetings, ten symposiums and six technical workshops.

Stakeholders engaged and consulted included

- 68 First Nations including both large and small oil and gas producers;

- First Nations located in geographic areas with potential production;

- First Nation representative organizations (Indian Resource Council; Federation of Sovereign Indigenous Nations);

- IOGC Co-Management Board.

177 Canadian Oil and Gas Companies & Organizations

- Representative organizations (Canadian Association of Petroleum Producers Explorers and Producers Association of Canada);

- Individual companies with leasehold interests on First Nations lands.

8 Provincial Governments

- Provincial Departments / Ministries of Energy;

- Provincial oil and gas regulatory bodies.

IOGC maintains an up-to-date "Record of Consultations" on the Act and regulations on its public website.

Results Achieved in FY2018-2019

An official set (sometimes referred to as the "Blue-Stamped" copy or version) of the Draft Phase I regulations were readied early in Calendar Year 2017. In February 2017, at the request of oil and gas First Nations, further work was put into abeyance until important proposed accommodations could be considered. These accommodations provide First Nations with greater authority and control over their oil and gas resources as well as the ability to customize deals according to their specific community and business needs. A new set of Blue-Stamped regulations were readied in September 2017. This version addressed some of the concerns raised by oil and gas First Nations and Canada proposed that the remaining issues be addressed and accommodated as part of the regulations gazetting process.

On February 8, 2018, the JTC passed a unanimous resolution for the IRC to provide written support for the Draft Phase I regulations, including the proposal for their updating during the gazetting process. The IRC Board approved the JTC recommendation at the IRC Board meeting held on March 5, 2018. The next day (March 6, 2018), this was unanimously ratified by IRC member First Nations at the IRC Annual General Meeting. The IRC sent a letter dated March 12, 2018 to the Department confirming their support. As a show of good faith, and to ensure continued close co-operation and collaboration, in early March 2018, the IRC’s JTC Program Manager, Mr. David Shade, was asked to represent the IRC, and its membership, as a permanent member of IOGC’s MARS Project Steering Committee.

It was agreed by all parties that any further accommodations would be made during the gazetting process. In early FY2018-2019, the approvals process began for Treasury Board consideration and approval for pre-publication in the Canada Gazette, Part I. The Draft Phase I regulations were approved by Treasury Board and were pre-published in the Canada Gazette, Part I on May 18, 2018 for a 90-day public review and comment period that ended on August 17, 2018. They were also published simultaneously in the First Nations Gazette for public review and comment over this same period. IOGC sent letters by regular mail to all oil and gas-producing First Nations on May 22, 2018 and on June 28, 2018 regarding consultation and information on how they could provide feedback on the proposed, Draft Phase I regulations. In addition, to ensure complete transparency, IOGC sent letters dated June 28, 2018 and July 19, 2018 to all oil and gas-producing First Nations and to industry with active interests on First Nations lands outlining the changes that were being contemplated as a result of feedback received.

IOGC's approach to consultation and engagement yielded a total of 130 comments from a total of 17 clients and stakeholders. Feedback and questions received mostly concerned the implementation of the new legislative and regulatory regime. The IRC, six First Nations, four oil and gas companies, one industry organization, four oil and gas-producing provinces, and a member of the general public submitted feedback. The remaining accommodations to address First Nations’ concerns were made and the official or "Blue-Stamped" Final Phase I regulations were near-ready for departmental approval in late FY2018-2019. Should these Final Phase I regulations be ready, as expected, in early FY2019-2020, they could be on a trajectory that would have them – in early FY2019-2020 – considered by Treasury Board, approved for publication in the Canada Gazette, Part II, and then brought into force together with the 2009 Act.

Key Project #2 – Resource Information Management System 2 (RIMS2)

a) Business Process Modernization

To optimize the benefits to First Nations of the new on-reserve legislative and regulatory regime, its implementation needs to include modernized business practices supported by enhanced informatics. IOGC uses business process mapping / modeling tools to:

- Review existing business practices and processes to ensure synergy and compliance;

- Identify and eliminate duplication of effort; and,

- Reduce red tape and streamline procedures.

Business process modelling and modernization is important because it helps identify the business and user requirements for informatics – new tools, changes needed to existing tools, or identifying data sources that can replace and retire existing ones. It also provides a means of ensuring that IOGC staff continues upgrading their knowledge and expertise of new processes, therefore, allowing them greater responsibility. This benefit results in greater transparency for IOGC’s clients and stakeholders.

b) Informatics Enhancements

A key deliverable in the Informatics Enhancements activities will include an information management activity to document all the business processes that support, or are beneficiaries of, the enhanced system development.

IOGC’s existing Resource Information Management System (RIMS) is the system that stores data concerning all surface and subsurface agreements, Indian interest wells, and royalty entities. The informatics enhancements that support the implementation of the new Act and regulations are known as the "RIMS2 Project". The RIMS2 Project is a joint initiative between IOGC and the Information Management Branch of Crown-Indigenous Relations and Northern Affairs Canada. In May 2016, the RIMS2 Project received both Project and Expenditure Approvals from Treasury Board.

The proposed RIMS2 Project provides for IOGC membership and data exchange with Petrinex (PETRoleum INformation EXcellence). Petrinex is the result of a unique provincial-industry partnership that created, and which currently operates and maintains, the recognized, authoritative source for hydrocarbon volume and pricing information. IOGC’s request for membership in Petrinex was approved in October 2013. Petrinex partners currently include the provinces of Alberta and Saskatchewan as well as the oil and gas industry.

The proposed RIMS2 Project solution includes:

- Petrinex data exchange with IOGC;

- New Royalty Management functionality; and,

- Introduction or Piloting of Case Management Capability.

The procurement process began shortly after Treasury Board provided both Project and Expenditure Approvals. A contract by Public Services and Procurement Canada (PSPC) was issued in November 2016 to Fujitsu Consulting Canada Ltd. to begin development work within the Petrinex environment.

Results Achieved in FY2018-2019:

In terms of the new Royalty Management functionality:

- During Q1, the 14 royalty calculation mechanisms needed for active leases in Saskatchewan had been identified, completed, and had passed acceptance testing while work had begun on the 44 mechanisms identified in Alberta;

- In Q2, design work on the Gas Cost Allowance module had been completed to support a possible implementation date in Q4; and,

- In February 2019, a major project milestone was reached when the new Gas Cost Allowance (GCA) capability was developed and deployed, as planned and scheduled. IOGC's clients and stakeholders will be using this new feature for the next period for their GCA reporting and the new tools and processes are expected to facilitate and streamline reporting.

With respect to both the Royalty Management and the Introduction or Piloting of Case Management components of the RIMS2 project, workshop sessions with IOGC subject matter experts began in Q4 the previous fiscal year. The initial work focused on the planning for and development of the Royalty Calculation Engine, defining the data needs and sources for data used in the royalty schema’s as defined in the leases and the database to support this data. This work led to the development of a prototype Royalty Calculation Engine. The RIMS2 Project is forecasted to be completed in FY2020-2021.

Key Project #3 – Phase II Regulations Development

A staggered or phased approach to regulations development means that regulations will be progressively developed and brought into force until the existing 1995 Regulations have been entirely replaced by new, modern regulations.

Results Achieved in FY2018-2019:

IOGC has been working with the JTC on regulations, beyond those contained in the Phase I package of regulations, for a number of years. Progress has been impacted by limited access to the same subject matter experts required to: 1) finish work on the Phase I regulations and preparing to bring them, together with the 2009 Act, into force; and, 2) organizational readiness activities so IOGC and its staff are prepared to implement and to administer the 2009 Act and Phase I regulations, beginning on the first day they both become law.

In FY2018-2019, a strategy change was adapted that would see JTC take the lead on one or more Phase II regulatory modules while IOGC focused attention on implementation readiness for the 2009 Act and its Final Phase I regulations. It is forecasted that IOGC will re-engage with the JTC on work related to the Phase II regulations some six months after the 2009 Act and the Phase I regulations have become law.

Operations

IOGC has four directorates that administer and manage the exploration and development of oil and gas resources on First Nations lands:

- Executive

- Lease and Royalty Administration

- Regulatory Compliance

- Planning and Corporate Services

1. Executive Directorate

The Executive Directorate focuses on:

- Setting corporate direction and strategy;

- Fostering effective working relationships among First Nations, industry, and government via:

- Consultation and effective partnerships;

- Implementation of the directives of the IOGC Co-Management Board; and,

- Organizational Change Management (OCM).

The Executive directorate contains three units: Strategic Projects; Communications and Executive Services; and, the Project Management Office.

a. Strategic Projects Unit

- Supporting other IOGC units with business process improvements;

- Leading RIMS2 informatics enhancements;

- Creating strategic partnerships for data exchange with authoritative sources;

- Facilitating IOGC business units access to services such as:

- business process mapping and modernization

- business analysis / advisory services

- technical writing

b. Communications and Executive Services Unit

- Disseminating information to First Nations, oil and gas industry companies, the public and government;

- Developing corporate communications and strategies regarding IOGC issues that have the potential to impact First Nations or the private sector;

- Developing and preparing briefing material on IOGC issues for senior departmental officials and the Minister;

- Preparing communications plans, strategies, reports (including the IOGC Annual Report, the quarterly MARS Newsletter, and Information Letters or Notices on IOGC’s website), and correspondence on IOGC activities;

- Maintaining IOGC’s Internet and Intranet websites; and,

- Assisting IOGC’s directorates with their communications requirements.

c. Project Management Offices – MARS and OCM

- Providing project co-ordination services for the MARS project;

- Providing services related to OCM, which focuses on the "people side" of change, including the access to professional services in this area of specialty.

Special Subject: Province of Alberta’s Announced Crude Oil Production Curtailment

On December 2, 2018, the Government of Alberta announced a temporary curtailment of crude bitumen and crude oil production that will start on January 1, 2019. According to the province, Alberta produced more crude oil in 2018 than could be shipped for export by rail or pipeline. This production affected storage levels, Canadian crude oil prices, and other market aspects. To protect the value of its oil, the Government of Alberta has temporarily limited production to match export capacity to prevent Canadian crude from selling at large discounts. Production curtailment requirements are to be assigned at the operator level and will be allotted by the provincial regulator to each operator.

Many First Nations in Alberta have expressed concern over Alberta’s oil production curtailment. Whereas oil and gas-producing provinces have access to other revenue streams – such as business and other taxes – to offset to some degree reductions in royalty revenue, not all oil and gas-producing First Nations have such additional revenue streams. Further, oil and gas royalty rates for production from First Nations lands are almost always higher than royalty rates in the surrounding province (royalty rates are generally higher for First Nations because the provinces receive revenue in other forms from the same business i.e., businesses pay royalty, fuel taxes, vehicle surcharges (registration), etc. to the provinces. Yet First Nations may only be collecting royalty and / or taxes, in the case of some First Nations. First Nation revenue stream from that one business is significantly lower than that of the province.). Since production curtailment requirements are assigned at the operator level, First Nations in Alberta are concerned that they will disproportionately be affected – that operators may decide to curtail their activities on First Nations lands, where they are paying a higher royalty rate, before they curtail their activities on other lands, where they are paying a lower royalty rate.

In response to the concerns raised by oil and gas-producing First Nations in Alberta, IOGC took the following actions:

- A statement was prepared (IOGC Statement: Alberta Curtailment of Oil Production and the Price Differential) and was distributed in printed format at the 2019 IRC Annual General Meeting, sent by regular post to all oil and gas-producing First Nations in Alberta, and, posted on IOGC’s Internet website (Note: The IRC membership passed a resolution at that Annual General Meeting that called upon IOGC to engage the Province of Alberta on the oil production curtailment issue);

- IOGC began regular, targeted monitoring of oil production from First Nations in Alberta to detect if First Nations were being disproportionately affected by the provincial initiative; and,

- IOGC reached out formally to the Alberta Ministry of Energy to present First Nations’ concerns and to offer to meet face-to-face to explore mitigation measures. IOGC sent a letter to the Alberta Minister of Energy formally requesting that First Nations’ lands be exempted from an operator’s calculation of its oil production so that First Nations would not be negatively impacted by the curtailment. The Alberta Minister of Energy declined IOGC’s request yet offered to meet in-person with IOGC to further discuss the issue.

2. Lease and Royalty Administration Directorate

The Lease and Royalty Administration Directorate is responsible for the issuance and administration of oil and gas agreements. The directorate contains five units: Negotiations, Contracts, and Research; Lease Administration; Royalties; Geology; and, Treaty Land Entitlement Support.

a. Negotiations, Contracts, and Research Unit

- Identifying disposition options with First Nations;

- Assessing proposals from interested companies to ensure fair return;

- Providing negotiation and facilitation expertise to reach agreements between First Nations and companies;

- Drafting and issuing subsurface oil and gas agreements;

- Administering subsurface continuances;

- Monitoring and verifying regulatory and contractual commitments;

- Verifying legal title and status of minerals for surrendered and designated First Nations lands prior to disposition; and,

- Providing title verification and confirming acreage for pooling purposes.

The royalty changes that were introduced by the Province of Alberta continue to have an impact on IOGC’s operations. The Negotiations, Contracts, and Research Unit continued to review agreements to assess the extent to which First Nation agreements have been affected by the Alberta royalty regime changes. This review confirmed that there is a continued requirement to dedicate significant resources to ensure these royalty changes are properly reflected in both existing and new agreements issued by IOGC on First Nations lands.

The Negotiations, Contracts, and Research Unit, by working diligently with all stakeholders, was able to continue to implement competitive agreements as compared to provincial royalty regimes. The Negotiations, Contracts, and Research Unit was able to ensure that every new and amended disposition recommended last fiscal year provided a return to First Nations that was higher than both the Alberta and Saskatchewan provincial royalty regimes.

The total number of agreements issued varies from year to year; however, with the impact of the industry slow-down, in FY2018-2019, IOGC issued 3, subsurface agreements, seven less than last year. The total number of these agreements under IOGC administration was 604, comprising 240,725 hectares.

b. Lease Administration Unit

Responsible for managing the lifecycle of oil and gas surface tenure (surface leases, rights of way, exploratory licences, and other surface rights), processing certain subsurface tenure transactions, and the verification and maintenance of corporate information.

Specific duties of the unit include:

- reviewing and ensuring the execution of all surface tenure in accordance with negotiated terms and conditions and with federal government regulations;

- administering surface tenure throughout its lifecycle, including financial commitments, rent reviews, assignments, and surrenders;

- administering assignment and surrender of subsurface tenure;

- monitoring of First Nation suspense accounts, as it relates to surface tenure;

- coordinating remedial enforcement action for non-compliance issues on surface tenure; and,

- registering contracts and other instruments into the Indian Lands Registry System (ILRS)

In FY2018-2019, IOGC issued 33 surface agreements, an increase of 24 over the year before. When oil and gas prices are strong, IOGC typically processes between 145-450 agreements in a year.

The current trend is a continued decrease in dispositions as a result of lower commodity prices. During these uncertainties in the economy, due to the downturn of the energy sector, IOGC usually experiences a decrease in requests for new contracts coupled with a substantial increase in assignments and surrenders.

In FY2018-2019, surface land area under disposition amounted to 10,506 hectares. This is a decrease of 97 hectares from the previous year. This number includes new dispositions minus surrendered dispositions. Surface area under disposition refers to the actual amount of First Nations lands impacted by oil and gas development.

In FY2018-2019, the total number of surface agreements under IOGC administration was 4,913. This is a slight decrease of 35 from the previous year. The total number of agreements varies from year to year. At some point in time, the number of surface leases will decrease as hydrocarbon resources eventually become depleted and sites are reclaimed.

In FY2018-2019, IOGC staff performed 961 registrations into the Indian Lands Registry System (ILRS); this is a significant increase from 702 the preceding year. The increase is due to a continued focused approach to clear a backlog of registrations.

c. Royalties Unit

IOGC is responsible for verifying and collecting royalty moneys generated by the production and sale of oil and gas resources from First Nations lands. The Royalties Unit is responsible for:

- Ensuring accuracy and completeness of royalty submissions;

- Conducting royalty assessments;

- Managing gas cost allowance deductions;

- Managing trucking deductions; and,

- Monitoring and addressing royalty moneys in suspense.

d. Geology Unit

IOGC’s Geology Unit is responsible for:

- Maintaining annual drilling statistics / summary; and,

- Conducting reviews for the continuation or termination of leases

Drilling on First Nations lands continued to reflect the national trend of reduced drilling activity, with a moderate to significant decrease in wells spudded in FY2018-2019 from the previous year. Industry reported 51 wells drilled on First Nations lands: 19 oil wells; 12 gas wells; 2 Dry and Abandoned wells; and, the remainder reported as steam or water injector wells. Twenty-eight (28) drills were licensed as horizontal wells. Additionally, 57 wells were approved for downhole abandonment, most of which will be cut and capped by December 2019. 145 leases were reviewed after their expiry with 32,590 hectares of land continued and 15,809 hectares expired.

e. Treaty Land Entitlement (TLE) Support Unit

The TLE Support Unit continues to provide TLE process guidance and oil and gas rights advice to First Nations engaged in Additions to Reserve (ATR) processes as a result of TLE. This Team supports:

- Verification of legal title and disposition information for surface and mineral agreements on status of minerals on designated TLE;

- Drafting and issuance of surface and subsurface Replacement Agreements (i.e., federal agreements, applicable on reserve lands, to replace existing agreements issued under provincial jurisdiction); and,

- Ensuring all ATR, specifically TLE stakeholders, are informed and understand IOGC’s role in the ATR process.

TLE claims are a type of land claim arising from the fact that some First Nations did not receive all the land they were entitled to under treaties signed with the Federal Crown. Today, the TLE process exists to fulfill these outstanding obligations. TLE often results in an ATR – that is, land is added to a First Nation’s reserve lands base – though First Nations can opt to receive other forms of settlement.

One of IOGC’s primary roles under the TLE process is to assist with Replacement Agreements for third-party interests that existed prior to the lands becoming reserve lands pursuant to a TLE claim. IOGC replaces agreements that are oil and gas-related, typically from provincial title and jurisdiction, which can then be administered according to the Indian Oil and Gas Act and its regulations once the lands become reserve lands under federal title.

In FY2018-2019 no new TLE claims were initiated at IOGC. As of November 21, 2019 there were 464 active Replacement Agreements being administered by IOGC on behalf of several First Nations who have exercised TLE rights. The revised work plan for the TLE Support Unit has identified another 267 Replacement Agreements that have been executed and are awaiting Ministerial Order for creation of additional reserve lands and a further 184 TLE transactions are being worked on, at various stages of completion.

Special Subject: Band-Owned Oil and Gas Companies

Many First Nations are no longer passive recipients of oil and gas royalties from their natural resources. In fact, they are becoming more involved in the oil and gas operations on their lands. First Nations have created Band-owned oil and gas companies (BOCs). The structure of each BOC can be different for every First Nation as it reflects their desired level of participation and their community goals. A BOC provides a First Nation with greater control, additional economic rent, and an opportunity for capacity building.

At the end of FY2018-2019, there were 18 BOCs holding 171 subsurface agreements comprising 59,440 hectares (25% of all lands managed by IOGC) of First Nations lands.

3. Regulatory Compliance Directorate

The Regulatory Compliance Directorate is responsible for maintaining a clear and transparent on-reserve oil and gas regulatory framework – supported by policy and enforceable rules – so as to encourage industry compliance, to take appropriate action to address instances of non-compliance, and to instill confidence in First Nations that resource development on their lands is conducted in a manner that minimizes environmental impact while conserving resources. The directorate contains five units: Environment; Compliance and Enforcement; Resource Analysis and Compliance; Technical Business Support; and, Policy.

a. Environment Unit

IOGC’s Environment Unit provides environmental stewardship for the complete lifecycle of upstream oil and gas activities on First Nations lands. FY2018-2019 was particularly challenging due to limited capacity and an increased workload related to industry bankruptcies, insolvencies, and changing economics. With capacity being limited, the Environment Unit prioritized building and maintaining relationships with First Nations and ensuring environmental compliance through joint field inspections. Below is a summary table of the primary activities completed by the Environment Unit in FY2018-2019.

| Activity | Performance Target | Results | Notes |

|---|---|---|---|

| Examine Environmental Review Forms | 95% within 4 weeks | 50 reviews completed |

|

| Review Environmental Audits | 100% reviewed by March 31, 2019 | 326 reviews completed |

|

| Joint First Nation - IOGC site inspections | 50 sites at 10-15 reserves | 129 inspections completed at 17 reserves |

|

| Joint provincial regulator-First Nation-IOGC site inspections | Joint inspections at 2-5 reserves | 34 sites at 4 reserves |

|

| Meet with First Nations on environmental issues | 30 meetings | 64 meetings |

|

| Meet with industry/environmental consultants | 21 meetings | 39 meetings |

|

| Conduct joint First Nation-Contract Holder-IOGC reclamation inspections | 100% within 18 months of receipt of complete reclamation application | 41 inspections completed |

|

In addition to the activities described in the table above, the Environment Unit also undertook:

- reviewing and annual monitoring of remediation projects;

- establishing First Nation community relationships to further the abandonment and reclamation of legacy sites in Ontario;

- engaging with industry and environment-related committees; and,

- updating the Environmental Management Information System.

The next fiscal year will continue to focus on the activities listed above, while creating new and updating existing policies, processes, and forms to reflect the pending changes required under the 2009 Act and its Phase I regulations.

b. Compliance and Enforcement

- Providing litigation support, including assisting Justice Canada and the departmental Litigation Management Resolution Branch (LMRB) with legal actions;

- Establishing a strategy for IOGC’s Compliance and Enforcement Framework;

- Ensuring readiness for implementation when the 2009 Act and its Phase I regulations come into force; and,

- Monitoring quality assurance of instruments that have compliance / enforcement impacts.

c. Resource Analysis and Compliance

- Maintaining well files on all newly-drilled wells:

- Managing trespass and potential drainage situations, including enforcement;

- Preparing revenue forecasts; and,

- Conducting ongoing and routine engineering and geology work including review of notices and applications.

The Resource Analysis and Compliance unit has two main goals – the first is to support conservation of the oil and gas resources of First Nations and the second is to provide First Nations with information forecasting oil and gas activity and projected revenues from such activity on their lands. The unit strives to provide a high level of service to First Nations related to its assigned functions.

One of its most important functions is to conduct drainage monitoring and issue drainage notices. To carry out this function, the unit monitors off-reserve wells producing close to reserve boundaries. Each of these situations is reviewed to determine whether or not drainage may be occurring. Where IOGC believes that drainage may be occurring, and where the relevant First Nations lands are leased, the First Nation’s band council is contacted so that a joint determination of potential drainage may be made. Once such a determination is made, IOGC will prepare and issue a drainage notice to the relevant lessee(s) of the First Nations lands in consultation with the band council. If the Unit believes that drainage may be occurring and the adjacent First Nations lands are not leased, then IOGC’s Negotiations, Contracts, and Research Unit and the First Nation are advised so that any opportunities for leasing the First Nations lands can be investigated.

One of the Unit’s most popular services is the revenue forecast service, whereby assigned engineers prepare royalty revenue forecasts and land revenue forecasts for First Nations with oil and gas activity. In FY2018-2019, the unit completed 45 revenue forecasts – 33 for First Nations in Alberta, 11 for First Nations in Saskatchewan, and 1 for First Nations in Manitoba. The forecasts increased by one for FY2018-2019. Usually each revenue forecast is comprised of two scenarios, a base case and a low case, and separate forecasts are provided for each. On occasion, a high case scenario may also be provided for a First Nation, where warranted.

d. Technical Business Support Unit

The Technical Business Support (TBS) Unit contributes to the Regulatory Compliance Directorate mandate by:

- Initiating and coordinating production and royalty-related audits, examinations, investigations, and inspections to ensure safe and appropriate field operations and a fair return to First Nations for the development of their resources;

- Collaborating and coordinating research with respect to technical, economic, and regulatory issues; and,

- Supporting IOGC, other Government of Canada bodies, First Nations, and provincial agencies.

The TBS Unit responds to many and varied requests from IOGC business units, First Nations, other government organizations, and the oil and gas industry. These requests include: modifications to royalty structures; consideration of financial issues; coordination and collaboration in federal and provincial initiatives; support for specific claims; investigation into existing and emerging issues; provision of technical data, information, and advice to support royalty assessment; and, initiating and supporting compliance actions.

During FY2018-2019 TBS staff conducted several field inspections for the purposes of ensuring safe operations and compliance with oil and gas production measurement, allocation, and reporting requirements. The TBS Unit responded to requests for assistance for five specific claims that have oil and gas components and assisted with a long-time litigation case. They concluded a two-year production examination at one First Nation and continued into the second year of another significant audit and examination at another First Nation. They assisted an investigation into a leaking well on one First Nation and inspected recently shut-in wells at still another First Nation.

In the meantime, unit staff initiated 39 desk reviews of commodity prices reported at over 30 First Nations and initiated or continued three royalty-related audits. In mid-summer, unit staff also responded to an IOGC Co-management Board request for a presentation and discussion of commodity prices.

The Unit provided various support almost daily to other IOGC and ISC / CIRNAC units with respect to on-going issues.

Oil Production from First Nations Lands

Crude oil is found in geological formations hundreds or thousands of metres deep in the subsurface of the earth. Most of the formations appear to be "solid rock" but they contain oil in generally very small openings (called "pore spaces") within the otherwise solid-looking rock formations. The oil also contains natural gas dissolved in it, like the gases that appear in soda pop when a bottle cap is removed. When the oil is produced, the gas "bubbles out" of the oil as it rises to the surface and even more gas "bubbles out" as the oil is treated and stored at the surface.

During FY2018-2019, oil was produced from 32 reserves belonging to 23 First Nations. The oil production history chart indicates that oil production from First Nations lands increased by about 15.4% compared to the previous year. Total First Nations oil production in FY2018-2019 was approximately 889,000 cubic metres, up from 770,000 cubic metres the year before. As in previous years, most of the oil produced from First Nations is heavy oil.

The majority of FY2018-2019 oil production, approximately 75.5%, came from First Nations in Saskatchewan, up slightly from the 2017-2018 percentage of 69.0%.

Description of figure A – History of Oil Production from First Nations lands, 2008-09 to 2018-19

This graph shows oil production from First Nation lands, in western Canada, from fiscal years 2009-2010 through 2018-2019. Units are in thousands of cubic metres per year:

- 2009-10: Alberta 443, Saskatchewan 275, Total 718;

- 2010-11: Alberta 552, Saskatchewan 459, Total 1,011;

- 2011-12: Alberta 665, Saskatchewan 517, Total 1,182;

- 2012-13: Alberta 658, Saskatchewan 445, BC 0.003, Manitoba 0.087, Total 1,103;

- 2013-14: Alberta 537, Saskatchewan 388, Manitoba 0.398, Total 925;

- 2014-15: Alberta 473, Saskatchewan 325, Total 798;

- 2015-16: Alberta 402, Saskatchewan 352, Total 754;

- 2016-17: Alberta 294, Saskatchewan 511, Total 805;

- 2017-18: Alberta 238, Saskatchewan 532, Total 770;

- 2018-19: Alberta 217, Saskatchewan 672, Total 889.

From fiscal year 2011-2012 to fiscal year 2015-2016, oil production from First Nations lands decreased from a peak of almost 1.2 million cubic metres to a low of 754 thousand cubic metres. However, oil production has since rebounded by almost 20% by fiscal year 2018-19, most of it from Saskatchewan First Nations.

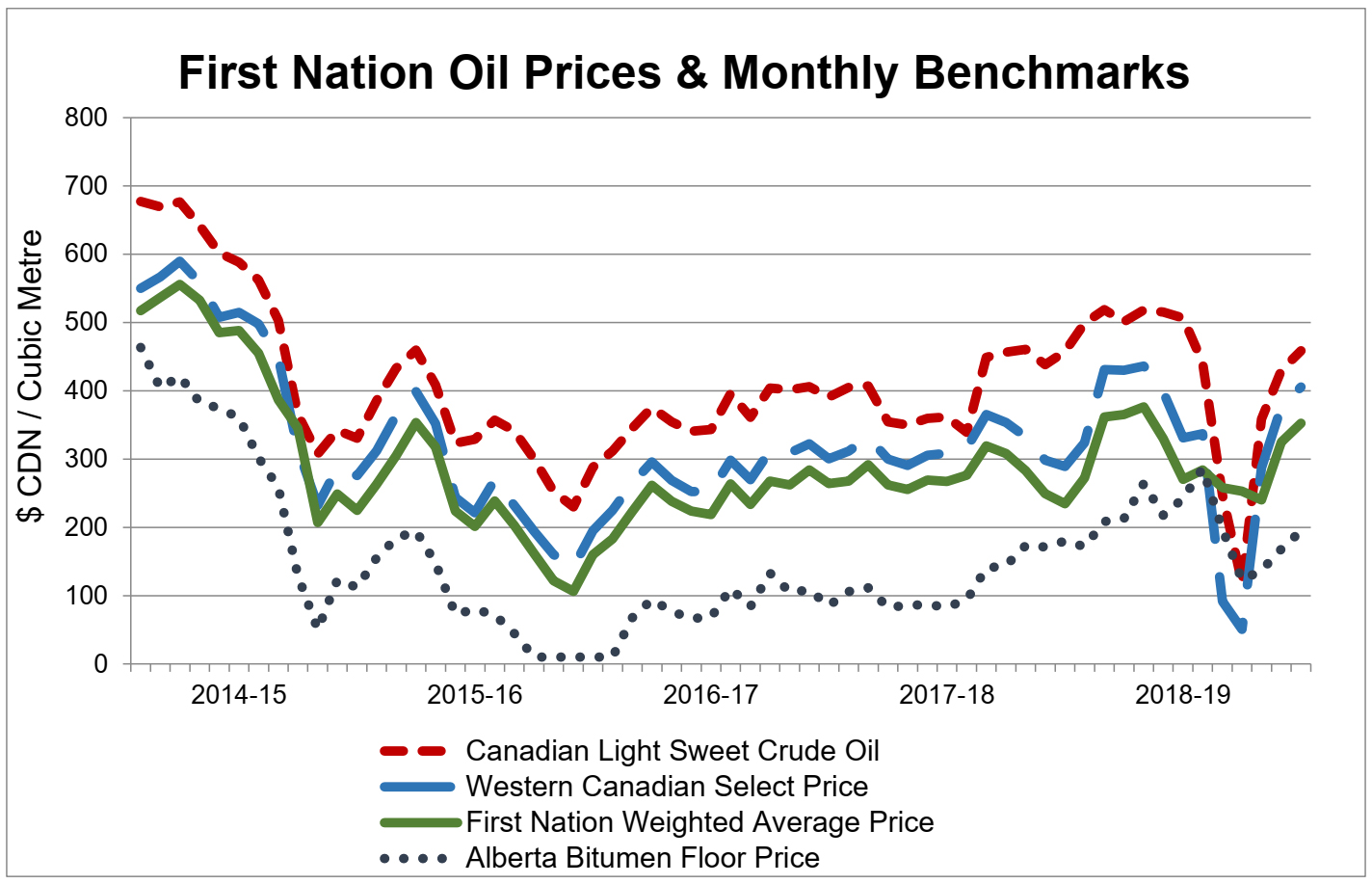

Oil Prices

As reported in previous years, prices for oil, natural gas and natural gas products fluctuate according to a wide variety of influences. Canadian oil prices, for example, are influenced principally by North American market conditions, proximity to their respective markets, pipeline and other infrastructure capacity and availability, alternate transportation options, the need for storage and blending or dilution, US drilling and production levels, and US crude oil inventories. Yet Canadian prices, like other benchmark and contract prices, also feel the effects of geo-political and geo-economic activities: OPEC; the Middle East; Russia; Mexico and Central America, to name just a few.

Fiscal year oil prices were robust until the realization of a sustained oil oversupply in December 2018 which, along with fears of a world-wide economic slowdown, led to a sudden falloff of prices. Most susceptible was the price of Western Canadian Select (i.e., heavy) oil. It fell disproportionately compared to other, lighter density, benchmark prices. Because the "average" First Nation oil is between heavy density and bitumen, that average price dropped, too. Once again, there was concern expressed over "the differential" between higher light crude prices – exemplified by West Texas Intermediate (WTI) oil – and lower heavy crude prices – in this case, Western Canadian Select (WCS), which exceeded $40 per barrel, much higher than the normal $10 to $12 per barrel differential and even higher than witnessed before, during the winter of 2018, when the differential was briefly in the $30 per barrel range (that time due to infrastructure constrictions and refineries that had been deactivated briefly).

January 2019, however, saw cooperation among Middle East Gulf states and Russia to reduce production and exports and prices were able to rebound, almost to the same levels that were enjoyed before the brief falloff. Please note that this international cooperation coincided with production cutbacks imposed by the Alberta provincial government at the time in Alberta. Some credit those cutbacks with having an effect on prices, but those cutbacks were merely coincidental to the much more significant international cutback cooperation.

As noted in previous annual reports, the usual reasons for the WTI-to-WCS price differential stem from the differences in proximity to market, oil density (called "specific gravity" or, simply, "gravity") and other characteristics, like sulphur content, acid content, and the presence of other contaminants, as well as infrastructure constrictions and routine pipeline, storage, and dilution costs. The price falloff in the autumn of 2018 was an extraordinary circumstance, but it still pointed at the vulnerability of Canadian oil prices, especially heavier oil prices.

Once again, oil and gas-producing companies, as well as oilfield service companies, are facing difficult financial circumstances. As reported last year, several had gone out of business, cut back on capital expenditures and other operations, been acquired by competitors, or left Canada. This past year, unfortunately, that has continued and, as long as commodity prices stay at low-to-mid levels, it is likely to get worse. Again, as stated in the past few years, most industry experts believe that oil prices will not reach 2014 price levels, for example, for many years, if ever.

Meanwhile, the following graph indicates, as stated above, that average prices for First Nations' oil continue to track between heavy oil prices and bitumen prices. This is appropriate because the "average" First Nation oil has properties that place it between those oil varieties.

Description of figure B – History of First Nation Weighted Average Oil Prices versus Benchmark Prices, 2013-14 to 2018-19

This graph depicts the history of the prices of four types of Canadian crude oil through the five most recent fiscal years, 2014-15 through 2018-19.

In fiscal year 2014-2015, light density, sweet crude oil prices peaked near $700 per cubic metre during the summer of 2014 while prices for IOGC’s modeled and computed "average First Nation crude oil price" peaked in the mid-$500 range.

By January 2015, prices for light sweet crude oil had dropped to near $300 per cubic metre while the "average First Nation crude oil price" dropped to $200. Prices rallied briefly in summer 2015 to nearly $500 and nearly $400, respectively. Prices then declined until, by February 2016, they were at levels not seen since calendar year 2000.

Fiscal year 2016-17 brought a steady rise in oil prices. Light sweet crude oil prices were in the range of $350 to $400 per cubic metre while "average First Nation crude oil price" rose to a range between $260 to $280 per cubic metre.

Although oil prices fluctuated more during fiscal year 2017-2018 than fiscal year 2016-2017, they generally stayed within the same price range during both fiscal years.

In fiscal year 2018-2019, oil prices continued to rise. Light sweet crude oil prices reached just over $500 per cubic metre in summer 2018 while average First Nation oil prices reached the high-$300 range.

At the left hand side of Figure B, one can still see the end of the severe falloff in oil prices that began in the autumn of 2014. Those prices "bottomed-out" in the winter of 2015, then rallied to a certain extent into the summer of 2015, only to fall again even more severely. By the winter of 2016, prices were at their worst level in years.

The beginning of FY2016-17 saw the beginning of a slow – although fluctuating – climb in prices. There was a minor drop in prices over the summer of 2017, but they began a climb during late fall of 2017. That climb reached a sustained peak of $500 per cubic metre during the summer of 2018. As mentioned in the main body of this report, a US oversupply followed by pessimism over the world economy, led to a sharp drop in the autumn of 2018. But international cooperation among OPEC, Russia and others to bring about production and export cutbacks, resulted in another significant rally in prices, to nearly the same levels as the summer of 2018.

As explained in past annual reports, based on data received from companies that produce oil on First Nation lands, IOGC calculates what we call a "weighted average First Nation crude oil price". IOGC admits that the weighted average price is somewhat "artificial" in nature, but that price still provides both an estimate of value received, and an indication of the overall average characteristics of the various crude oils produced from First Nations lands.

During FY2018-19, the IOGC-generated weighted average First Nations price for crude oil indicates once again how the "average" First Nation oil is similar to heavy oil, with influences from bitumen pricing behavior. That is because most First Nation crude oil is produced from heavy oil / bitumen areas.

Thus, the average First Nation oil price followed the other oil benchmark prices – peaking near $400 per cubic metre in the summer of 2018, then falling significantly until it, too, rallied as a result of restoration of prices internationally in January 2019. At the end of FY2018-19, the average First Nation oil price hovered in the $300 to $400 per cubic metre range – again, just below the heavy oil-related Western Canadian Select prices. Meanwhile, that price, apparently, did not suffer as much as the other benchmarks during the autumn 2018 falloff, possibly due to contract prices or production circumstances.

Natural Gas Production from First Nations Lands

Natural gas, as with oil, also comes from geological formations hundreds or thousands of metres down in the subsurface. Again, the formations appear to be "solid rock" but they contain natural gas in small pores spaces within the otherwise solid-looking rock formations. Some formations contain only natural gas and, occasionally, some contain natural gas plus some associated products, like ethane, propane, butane, and even some hydrocarbon liquids. As mentioned earlier, natural gas can also originate in subsurface formations that contain oil. In the oil-bearing formations, the gas is dissolved in the oil. When the oil is produced, the gas "bubbles out" of the oil in the subsurface and at the surface as the oil is treated and stored. However, no matter where the natural gas originates from, it needs to go through some sort of processing to become sales gas. This processing may be fairly simple or more complex.

During FY2018-2019, natural gas was produced from 47 reserves belonging to 34 First Nations. The natural gas sales history chart indicates that natural gas sales from First Nations lands decreased by only 0.1% from FY2017-18. Total First Nation gas sales was once again just above 1.8 billion cubic metres. The vast majority of First Nation interest sales gas still originates from Alberta First Nations at slightly over 98%.

Description of figure C – History of Natural Gas Sales from First Nations, 2008-09 to 2018-19

This graph shows Natural Gas sales (that is, processed sales gas; not to be confused with raw produced gas) from First Nations lands, in western Canada, from fiscal years 2009-2010 to 2018-2019. Units are in millions of cubic metres per year:

- 2009-10: Alberta 901, Saskatchewan 150, British Columbia 2, Total 1,053;

- 2010-11: Alberta 901, Saskatchewan 107, British Columbia 2, Total 1,010;

- 2011-12: Alberta 968, Saskatchewan 81, British Columbia 2, Total 1,051;

- 2012-13: Alberta 979, Saskatchewan 64, British Columbia 1, Total 1,044;

- 2013-14: Alberta 1,091, Saskatchewan 52, British Columbia 1, Total 1,144;

- 2014-15: Alberta 1,685, Saskatchewan 44, British Columbia 1, Total 1,730;

- 2015-16: Alberta 1,751, Saskatchewan 42, British Columbia 1, Total 1,794;

- 2016-17: Alberta 1,523, Saskatchewan 38, Total 1,561;

- 2017-18: Alberta 1,805, Saskatchewan 34, Total 1,839;

- 2018-19: Alberta 1,812, Saskatchewan 29, Total 1,841.

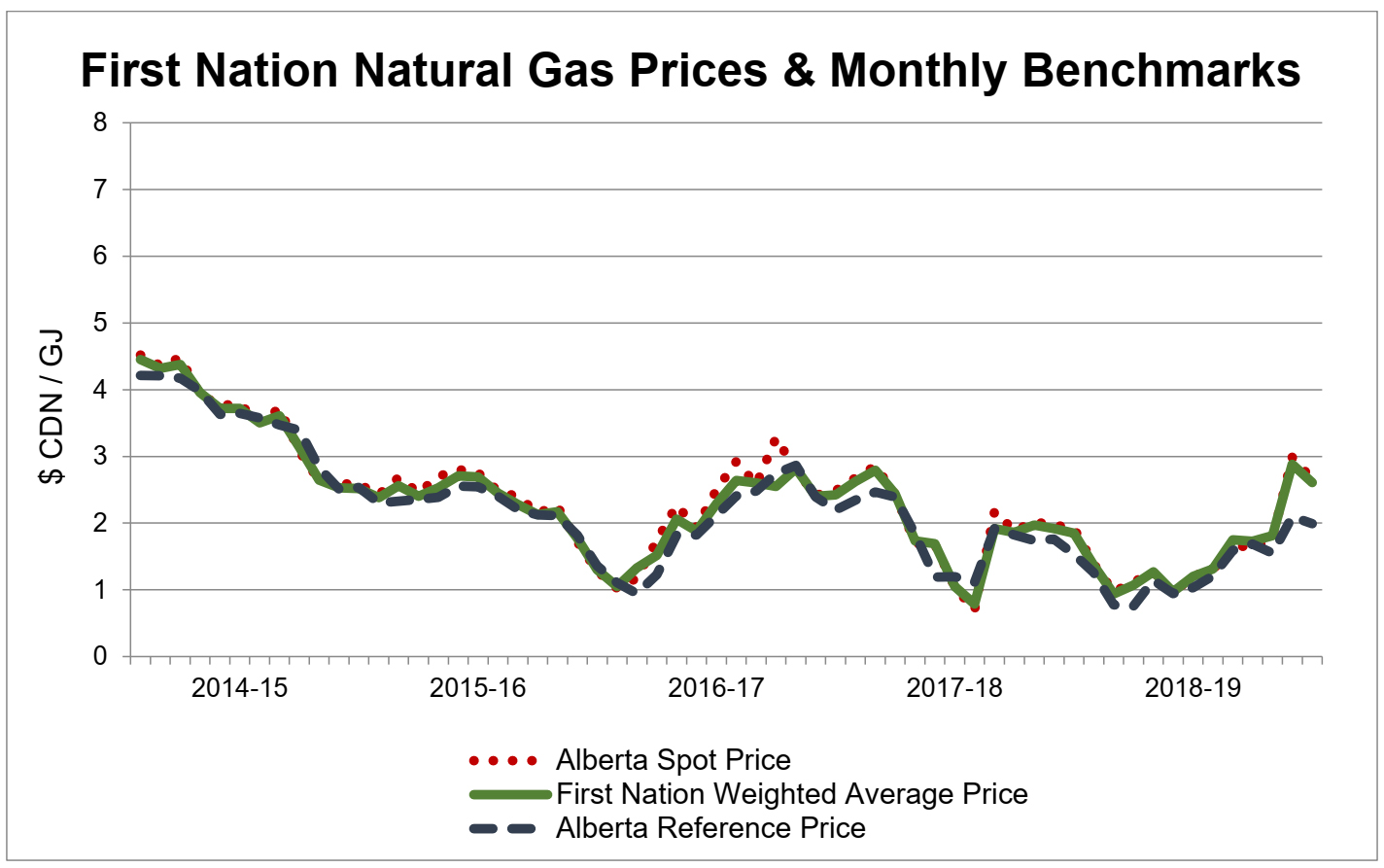

Natural Gas Prices

As stated in previous years, Canadian natural gas producers must compete for Canadian and US markets with US natural gas producers who have greater transportation infrastructure, less resistance to infrastructure expansion, higher commodity prices, and closer proximity to US and Canadian markets. Canada currently has no other market options, and won't have until LNG plants can be completed, allowing Canada to access new world markets.

As reported last year, FY2017-18 saw generally declining natural gas prices. FY2018-19 saw an initial continuance of that decline in prices until nearly historic "below $1 per gigajoule" lows were experienced in May and June of 2018. Thereafter, however, prices began to rally modestly until they reached a plateau of sorts in the autumn of 2018. Then, a couple of factors favoured them: the onset of the winter heating season with the realization that, due to cutbacks of natural gas drilling programs over the previous several years and the shutting in of gas fields to wait for "better times", natural gas storage capacity, used as a buffer in anticipation of winter, dropped to unprecedented low levels. The onset of winter increased demand for natural gas, therefore, causing a rapid increase in prices and those producers who could and did respond saw prices rise month-by-month to a peak of over $2 Canadian per gigajoule during a very cold February 2019. In March 2019, prices were still fairly steady near the $2 dollar level.

Again, we remind the reader that the somewhat higher natural gas prices quoted in the media every day do not reflect what Canadian producers get, they only reflect what American producers get because, among other factors, their fields are closer to their markets. Fields as far away as Canada must pay higher tariffs and fuel gas costs, for example, to supply those markets. Those costs affect the netback prices they receive.

Description of figure D – History of First Nation Weighted Average Sales Gas Prices versus Benchmark Prices, 2013-14 to 2018-19

The graph depicts the history of natural gas prices for the five most recent IOGC fiscal years, 2014-2015 through 2018-2019. Three prices are indicated:

- Firstly, a history of prices for natural gas sold on the Alberta Spot market (that is, traded on a public exchange for immediate delivery);

- Secondly, a history of Alberta Reference Prices, which are determined by the Alberta Government and then used to assess royalties owed to the province; and,

- Thirdly, a history of IOGC’s modeled and computed weighted average prices received for sales gas produced from First Nations lands.

At the beginning of fiscal year 2014-2015, prices for natural gas were near a peak of over $4 per gigajoule yet had been declining since before 2014-2015.

This decline continued until prices reached a low at the beginning of fiscal year 2015-2016. Prices then began to rise slightly – with some fluctuation – until they reached a high of just under $3 per gigajoule in August 2015.

After that, prices generally decreased until May 2016 when they reached less than $1 per gigajoule – the lowest prices since 1995. Prices then began a slow, yet fluctuating, increase to approximately $3 per gigajoule in early winter (December 2016 to January 2017).

Prices fluctuated between $2 and $3 per gigajoule until May 2017 when they experienced another steep decline to below $1 per gigajoule in October 2017. Spot prices reached a low of 47 cents per gigajoule, their lowest price in decades.

The 2017-2018 winter heating season saw another price rally – to over $2 per gigajoule in November 2017 – followed by fluctuations around $2 through the winter.

Spring 2018 saw prices dropping to a level below $1 per GJ again while Spot and reference prices reached 78 cents per gigajoule in May 2018. Prices then began to rally modestly until they reached a short-term peak around $2 per gigajoule in February 2019. Prices then dropped to below $1 per GJ once more, where they finished fiscal year 2018-2019.

In Figure D above, natural gas prices for FY2014-15 are declining from a high in the previous FY2013-14. Prices generally declined until May 2016 when they began to rebound. They rose to a near-$3 per gigajoule peak in early winter (December) 2016. Prices fluctuated between $2 and $3 per gigajoule until May 2017, when they began another steep decline to sub-$1 per gigajoule in October 2017. The coming 2017-18 winter saw another price rally – to over $2 per gigajoule in November, followed by fluctuations around $2 through the winter. In the spring of 2018, they dropped to a level below $1 per GJ again.

Thereafter, however, natural gas prices began to rally modestly until they reached a plateau of sorts in the autumn of 2018. Then, a couple of factors favoured them: the onset of the winter heating season with the realization that, due to cutbacks of natural gas drilling programs over the previous several years and the shutting in of gas fields to wait for "better times", natural gas storage capacity, used as a buffer in anticipation of winter, dropped to unprecedented low levels. The onset of winter increased demand for natural gas, therefore, causing a rapid increase of prices and those producers who could and did respond saw prices rise month-by-month to a peak of over $2 Canadian per gigajoule during a very cold February 2019. In March 2019, prices were still fairly steady near that two dollar level.

Like crude oil, based on data received from companies producing natural gas on First Nations lands, IOGC also calculates a "weighted average First Nation natural gas price". Like the weighted average oil price, this gas price also provides an estimate of value and an indication of whether First Nation natural gas prices follow market prices.

During FY2018-19, the First Nation weighted average price for natural gas began at $1.37 per gigajoule, then declined to $0.94 per gigajoule in May 2018. It fluctuated for several months between $1 and $1.30 per gigajoule, then began to rise, echoing the benchmark spot price. It peaked just under $3 in the unexpectedly cold February 2019. In March, it was still near that level, at $2.61 per gigajoule.

When compared to the beginning of the fiscal year, the price had increased by just over 39%. Unfortunately, the price declined as it entered springtime and the beginning of FY2019-20.

e. Policy Unit

Regulatory Compliance’s Policy Unit is responsible for:

- Advising on strategic policy;

- Researching and developing operational policy;

- Monitoring and preparing responses to Parliament on changes to provincial regimes; and,

- Consulting on operational and strategic policy changes.

The Policy Unit’s primary focus has been the development of new regulations. The Department adopted a phased approach for regulations development designed to have the 2009 Act become law sooner than if a full set of regulations were completed. This approach ensures that First Nations will benefit sooner from the improvements embodied within the IOGA, 2009 which provides new authority for IOGC in the following areas to:

- Audit companies working on First Nations lands;

- Determine and advise industry of longer records retention time for auditing purposes;

- Deal more effectively with surface and subsurface trespass;

- Protect First Nation sites of cultural importance;

- Order companies to take remedial action under certain circumstances; and,

- Issue fines and penalties for offences under the Act or regulations.

Furthermore, the phased approach will require updates to the Indian Oil and Gas Regulations, 1995 – ensuring they are in congruence with the IOGA, 2009 – including new regulations in the areas of:

- Drainage and Compensatory Royalty;

- Subsurface Tenure;

- First Nations’ Audit (a component of Royalty Management); and,

- Reporting Requirements to Facilitate Royalty Verification.

The remaining regulatory modules will become law once they are completed and, at the end of the process, IOGC will have jurisdiction to oversee and enforce a complete set of new, modern regulations. In consideration of the time required to accommodate input from stakeholders and the government’s regulations review and approval process, it is projected that the 2009 Act and its regulations will come into force in Calendar Year 2019. The Policy Unit spent much of the past year working on the new regulations while consulting, engaging, and informing First Nations. Throughout the regulations development process, upon request, face-to-face meetings have taken place with individual First Nations, Tribal Councils, and Treaty Areas, as well as with the Joint Technical Committee (JTC) and at the Indian Resource Council (IRC) Annual General Meeting where updates were presented.

4. Planning and Corporate Services Directorate

The Planning and Corporate Services (PCS) Directorate’s key responsibilities include management planning, administrative policy, human resources, finance, procurement, office administration, information management and information technology. PCS also acts as secretariat to the IOGC Co-Management Board. The PCS directorate includes five groups: Contracts and Administration; Finance; Human Resources; Planning, Administrative Policy & Corporate Coordination; and, Information Technology.

a. Contracts and Administration Unit

- Contract and procurement services;

- Material management services;

- Office administration, accommodation, and tenant services;

- Security services; and,

- Information Management, records, resource library, and Access to Information and Privacy Act (ATIP) services.

b. Finance Unit

- Corporate financial services;

- Resource planning;

- Trust fund administration;

- Accounts payable; and,

- Accounts receivable.

c. Human Resources Unit

- Human resources planning and reporting;

- Employee recruitment;

- Staff relations and workplace well-being;

- Compensation and benefits;

- Training and career development;

- Classification and organizational development;

- Human resources policy development; and,

- Official languages.

d. Planning, Administrative Policy & Corporate Coordination Unit

- Annual IOGC Management Plan;

- Quarterly reporting;

- IOGC inputs into CIRNAC plans and reports;

- IOGC Co-Management Board secretariat services;

- Implementing corporate-wide departmental and government-directed initiatives and administrative policy development;

- Occupational Safety and Health (OSH);

e. Information Technology Unit

- Database administration;

- Technical support to application development;

- RIMS1 Steering Committee governance;

- Distributed computing including end user support (via call centre);

- Hardware and software management;

- Shared Services Implementation;

- IT security; and,

- Technical support for video-conferencing, smart-boards and rollout of other HQ technology and systems.

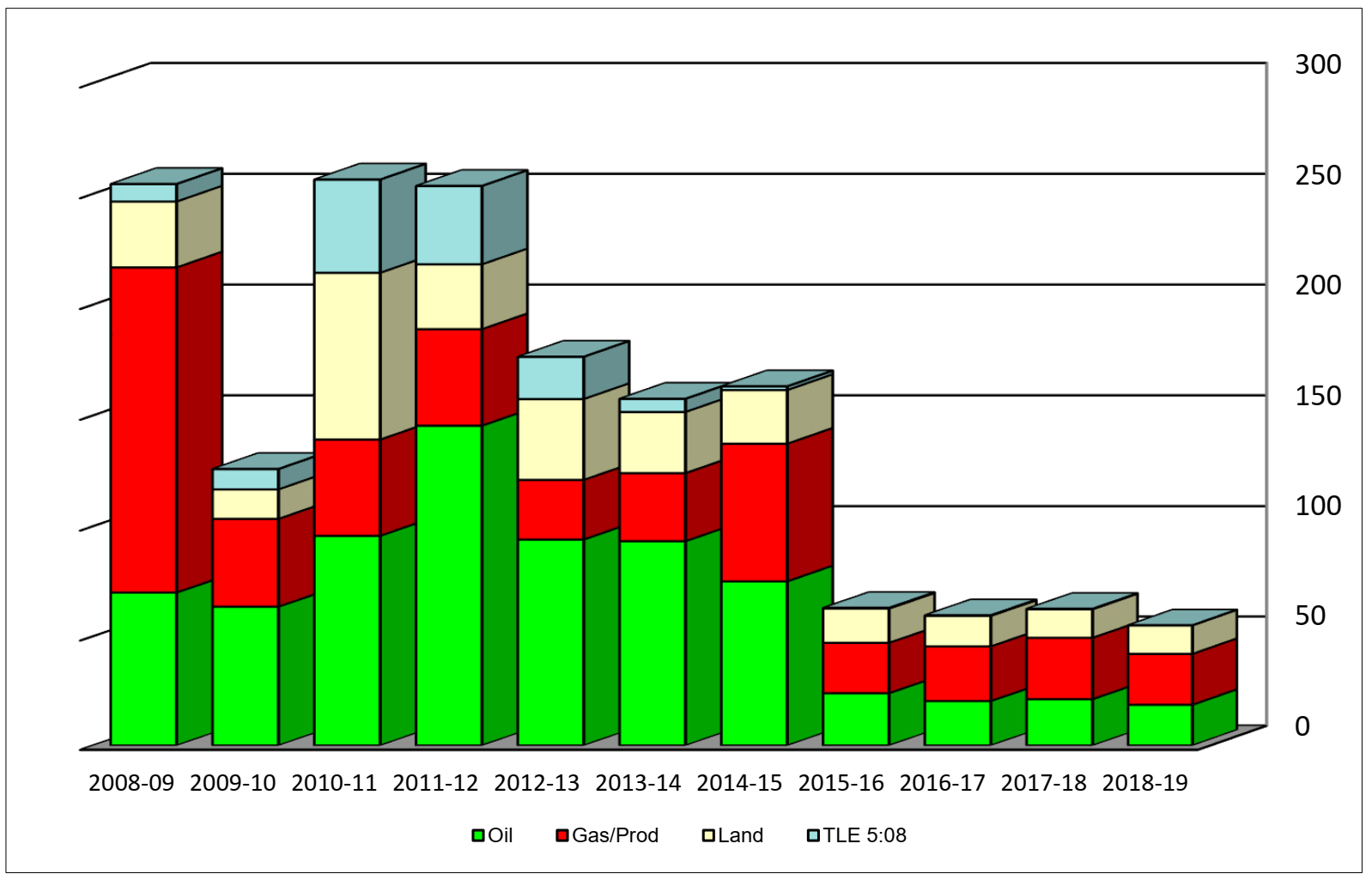

Revenues Collected on Behalf of First Nations

During FY2018-2019, IOGC received $55.0 million on behalf of First Nations. This included $41.9 million as a result of oil and gas royalties, $910,000 in bonuses, $12.1 million in compensation and rentals, $45,555 in royalties from Treaty Land Entitlement 5.08 lands, and $21,949 in interest.Footnote4

Description of figure E – History of Moneys collected on behalf of First Nations FY2008-09 to FY2018-19

This chart shows oil and gas-related revenues that IOGC collected on behalf of First Nations from fiscal years 2008-2009 to 2018-2019. Units are in millions of dollars.

- 2008-2009: Oil $47.76; Gas and Gas Products $133.25; Land $16.20; Treaty Land Entitlement 5.08 Lands $5.14

- 2009-20010: Oil $70.04; Gas and Gas Products $146.79; Land $29.73; Treaty Land Entitlement 5.08 Lands $7.89

- 20010-2011: Oil $63.56; Gas and Gas Products $39.78; Land $13.31; Treaty Land Entitlement 5.08 Lands $9.17

- 2011-2012: Oil $95.69; Gas and Gas Products $43.44; Land $75.27; Treaty Land Entitlement 5.08 Lands $42.04

- 2012-2013: Oil $145.39; Gas and Gas Products $43.56; Land $29.26; Treaty Land Entitlement 5.08 Lands $35.33

- 2013-2014: Oil $94.02; Gas and Gas Products $26.91; Land $36.48; Treaty Land Entitlement 5.08 Lands $19.04

- 2014-2015: Oil $93.26; Gas and Gas Products $30.72; Land $27.60; Treaty Land Entitlement 5.08 Lands $5.90

- 2015-2016: Oil $75.15; Gas and Gas Products $62.12; Land $24.20; Treaty Land Entitlement 5.08 Lands $1.65

- 2016-2017: Oil $23.96; Gas and Gas Products $23.06; Land $15.64; Treaty Land Entitlement 5.08 Lands $0.315

- 2017-2018: Oil $20.37; Gas and Gas Products $25.01; Land $13.95; Treaty Land Entitlement 5.08 Lands $0.26

- 2018-2019: Oil $21.23; Gas and Gas Products $28.09; Land $13.03; Treaty Land Entitlement 5.08 Lands $0.208

Human Resources at IOGC

IOGC is committed to ensuring a safe and healthy work environment where all staff are valued and treated with respect, dignity and fairness.

At IOGC, we fully recognize that our people make our organization what it is. We are proud of our diverse workforce and our employment equity representation levels which exceed labour market availability. Tremendous synergy results when differing viewpoints, skill sets, and experiences are brought together. IOGC employees are professional and bring their best to the achievement of our organization’s mandate, vision, and values.