Electronic Royalty Data Submission - User Manual

PDF Version (881 Kb, 27 Pages)

Table of contents

- 1. Background Information

- 2. Reporting Royalty Data

- 2.1 General Functionality

- 2.1.1 Getting Started

- 2.1.2 Log In

- 2.1.3 Main Menu

- 2.1.4 Message Centre

- 2.1.5 Enter Gas Royalty Statement

- 2.1.6 Upload Gas Royalty Statement File

- 2.1.7 Enter Oil Royalty Statement

- 2.1.8 Upload Oil Royalty Statement File

- 2.1.9 Sample OIL Statement (electronic format)

- 2.1.10 Oil Royalty Statement

- 2.1.11 Change Password

- 2.1.12 Site User Manual (PDF)

- 2.2 Administrative Options

- 2.1 General Functionality

- 3. Appendix A – Troubleshooting Guide

- 4. Appendix B – Marketer/Purchaser Codes

- 5. Appendix C – Terminology

1. Background Information

Indian Oil & Gas Canada (IOGC) is responsible for the management, administration and timely disposition of oil and gas resources on Indian reserves across Canada. A key component of this responsibility is the verification and collection of royalty payments on behalf of First Nations.

IOGC is redesigning its internal business processes to ensure the accuracy, timeliness and consistency of the royalty collection process. IOGC is also redesigning its interactions with industry, with a focus on simplifying the exchange of information through technology.

This document is intended to provide Royalty Payors with instructions for electronically submitting royalty data. In 2005, IOGC will be issuing a major revision to its Royalty Reporting Guidelines, which will incorporate these and other changes to the royalty process.

1.1 Overview of Electronic Submission System

1.1.1 Purpose

In the past, Royalty Payors submitted all data to IOGC on paper forms – the Gas Royalty Statement (GRS) and the Oil Royalty Statement (ORS). In order to use this data, IOGC had to key it into our Resource Information Management System (RIMS). In addition to being time consuming, re-keying the data also introduced the potential for incorrect data to be entered to RIMS. The production, submission and filing of paper records also created significant amounts of overhead for IOGC and Royalty Payors alike.

To reduce overhead costs, improve the timeliness of information and reduce the potential for errors, IOGC has implemented an electronic data submission system. This system takes data directly from the Royalty Payor and validates it against a set of business rules. If the data is rejected, the Royalty Payor is notified and is responsible for making the required corrections. If the data is accepted, IOGC's RIMS database is automatically updated.

1.1.2 System Concept

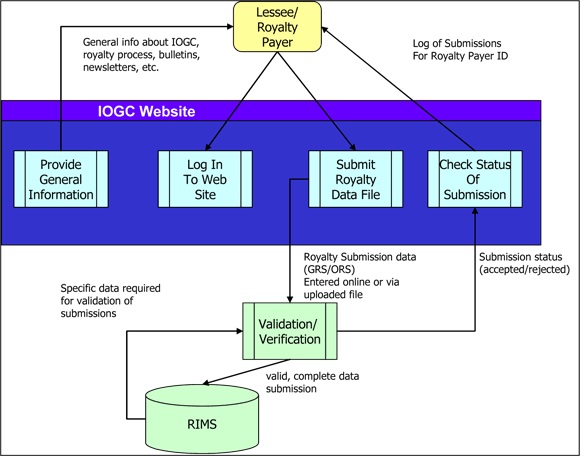

The following graphic shows a high level, conceptual view of the electronic submission system:

Text description of the High-level, conceptual view of the electronic submission system

This graphic illustrates the full-cycle process that both royalty payers and IOGC follow in the submission and receipt of royalty data. It shows the process of royalty payers logging in to the system, submitting their royalty data either via uploaded file or entered online, and checking the validation status of their submission once it has been accepted or rejected by IOGC. The graphic also shows that, upon receipt, IOGC checks the data’s completeness and sends the validation status back to the royalty payer, ensuring that complete records are kept in IOGC’s database, the Resource Information Management System (RIMS).

Users authorized by Royalty Payors are able to log in to a secure area of IOGC's website to access electronic business services, including royalty data submission. The website will provide a mechanism for Royalty Payors to submit royalty data to IOGC using 1 of 2 methods:

- Enter data using a simple online form.

- Submit a standardized file with royalty data.

In either case, the submitted data is validated against a set of business rules to ensure all required fields are completed and that the data is valid for the submitting Royalty Payor. The validity status of the data is then returned to the Royalty Payor's "Submission History". This provides a listing of all submitted files and their validation status. The Royalty Payor has the responsibility to review the status of submitted data and ensure all statements have been processed and accepted by IOGC.

1.2 Royalty Reporting

The following sections outline the timeline and requirements for royalty reporting:

1.2.1 Timeline

In addition to implementing electronic data submission, IOGC is revising the timelines by which data must be submitted. The intention of this revision is to ensure Royalty Payors are able to finalize all data elements (including data beyond their control, such as FARR percentages) prior to making their submissions.

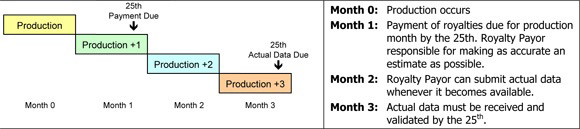

The timeline for royalty reporting is being adjusted to create a simpler, more consistent and fair process for Royalty Payors. The following graphic illustrates the new process that will be followed for monthly reporting to IOGC:

Text description of figure - Timeline for royalty reporting

This graphic illustrates the timeline to be followed for monthly royalty payment and reporting to IOGC. Payment of royalties is due by the 25th of the month following production, while submission of actual royalty data is due by the 25th of the third month following production. The royalty payer is responsible for making the most accurate estimate possible for the royalty payment, since all actual data is not available at the time the payment is due.

This timeline will provide Royalty Payors with sufficient time to collect and finalize all price and volume data. It is IOGC's intention to continue to work toward further reductions in the time required for the royalty cycle.

1.2.2 Estimate vs. Actual Data

Many Royalty Payors submit estimated data to IOGC then provide actual data as it becomes available. However, the submission of two sets of data for a particular production month imposes extra administrative burden on Royalty Payors and IOGC alike. For that reason, IOGC will no longer accept estimated royalty data. Instead, the changes in the submission timeline described above will make it possible for all Royalty Payors to collect and submit only actual data. This reduces workload for all Royalty Payors, avoids confusion over estimated vs. actual data and enables IOGC to perform its assessment process using the most accurate information.

1.2.3 Payment vs. Data Submission

Royalty Payors are still required to submit payment of royalties by the 25th of the month following production (or by the date specified in certain contracts). IOGC recognizes that the implication of this requirement is that the payment will be based on an estimated amount that will invariably differ somewhat from the actual data. IOGC's expectation is that Royalty Payors will continue to be diligent in their estimation of royalties such that there will be minimal differences between the amount paid and the amount assessed using actual data.

1.2.4 Backup Documentation

IOGC will continue to require Royalty Payors to submit backup documentation for:

- Actual Sales Price: Sales invoices or other third party verification of price

- Production Volume: Volumetric reports

IOGC's intention is to continue to enhance the capabilities of our website and make it possible for this information to also be sent electronically. Until further notice, however, this aspect of royalty reporting is unchanged.

Regardless of the eventual method by which this backup documentation is communicated, Royalty Payors remain responsible for providing this necessary information to IOGC.

1.2.5 Provision of Information to First Nations

Royalty Payors are currently responsible for providing First Nations with hardcopies of the same information that is provided to IOGC on a monthly basis. With the implementation of electronic submission, Royalty Payors will no longer be required to forward hardcopies of the Oil/Gas royalty statements (ORS/GRS) to First Nations. Instead, IOGC will compile and communicate this specific information to First Nations based on Royalty Payors' electronic submissions. Royalty payors will continue to be required to forward all other information they currently provide to First Nations, such as pricing backup and volumetric reports until further notice.

1.3 Electronic Submission Principles

A fundamental concept in the design of IOGC's electronic submission approach is that the Royalty Payor bears responsibility for how the system is used. There are a few implications of this concept:

- The Royalty Payor is responsible for creating and maintaining the users having access to the system under the Royalty Payor's ID. IOGC is not involved in the administration of the Royalty Payor's account. Instead, each Royalty Payor will designate one person as its "administrator" with the ability (and responsibility) to create, update and delete authorized users.

- The Royalty Payor bears full responsibility for data submitted and changes made by users who, for whatever reason, should no longer have access to the system but have not been deleted by the administrator.

- All electronic statements must contain complete and valid data or they will be rejected and returned to the Royalty Payor for correction.

- The Royalty Payor is responsible for reviewing the status of data submitted and ensuring that all required data has been successfully received and validated prior to the monthly deadline. Statements will be recognized as being received only when they include complete and valid data.

2 Reporting Royalty Data

With the implementation of electronic data submission, IOGC has discontinued the use of the Gas Royalty Statement (GRS) and the Oil Royalty Statement (ORS) in paper form. Royalty Payors are now required to use IOGC's website to submit monthly royalty data.

This section will provide instructions for each element of IOGC's electronic services.

2.1 General Functionality

The following section deals with functionality that is available to all users. A subsequent section will deal with functionality that is available only to the Administrator for each Royalty Payor.

2.1.1 Getting Started

After accessing IOGC's website and selecting "English" or "French" as the language, select "Electronic Services" to begin.

2.1.2 Log In

Text description of figure - screen capture of the Log In menu

This image is a screen capture of the log-in menu. The screen has entry fields for royalty payer id, user id and password, as well as two buttons for either login or reset.

To protect the confidentiality of Royalty Payor information all users must log in with:

- a valid Royalty Payor ID (number assigned to the Royalty Payor),

- a valid User ID (which is assigned to the user by the Royalty Payor's administrator), and

- a Password (which is created by the administrator and is managed by the user). See "Change Password" for a detailed description of the required password format.

After entering the above information, press "Login" to enter the website. If you make an error entering the information, press "Reset" to clear all fields.

2.1.3 Main Menu

Text description of figure - screen capture of the Main Menu

This image is a screen capture of the main menu. Royalty payers can select from a number of options, to enter or upload their oil or gas royalty statements, to view their submission history or general announcements, to change their password or to view the site user manual.

2.1.4 Message Centre

Text description of figure - screen capture of Submission History

This image is a screen capture of the submission history. It has listings of previous submissions by date and also shows status and corresponding file names. The status will originally be SUBMITTED, then will change to ACCEPTED or REJECTED after validation. Users must click on any REJECTED statuses to see why the submission failed so that they can re-submit correctly if necessary.

Submission History:

Each file that is submitted by a Royalty Payor

is reviewed for completeness and validity.

The status of the submitted files is returned to

the Submission History page. It is each

Royalty Payor's responsibility to ensure all

files have been accepted. Rejected files that

are not resubmitted by the deadline will be

considered to have been submitted late.

The Submission History includes:

- Date Submitted: The table is sorted by the date on which submissions were made.

- User ID: The ID of the user that made each submission.

- Status: The validation status of the submission. Possible values are:

- Submitted: The data has been received by IOGC but has not yet been checked for validity.

- Accepted: The data has been received, validated and accepted.

- Rejected: The data has been received, validated and rejected. The user is responsible for determining the reason for rejection, making the necessary corrections and resubmitting the data.

- Original Filename: The name of the file submitted by the User. If the data was submitted using the online form, this field will read "Entered Online".

- Submitted Filename: To ensure files received from all Royalty Payors can be

uniquely identified, IOGC renames each submitted file. This field will provide the

new name assigned to the submission. The naming convention is:

- Batch Submission: RoyaltyPayorID_RoyaltyType_Year_Month_Sequence#

- Online Submission: RoyaltyPayorID_RoyaltyEntityID_Year_Month_Sequence#

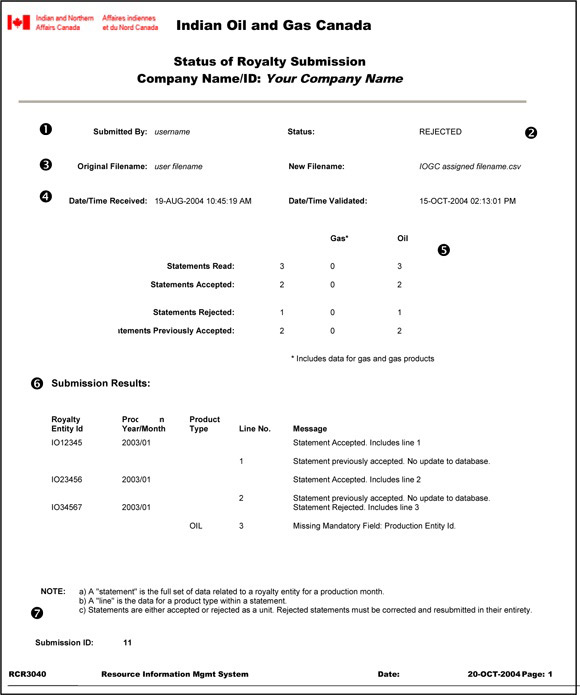

Text description of figure - screen capture of Status of Royalty Submission

This image is a screen capture of the status of royalty submission, normally viewed when a file is rejected. The screen details line by line submission results for the submitted file, including reasons for rejection of the line, such as missing a mandatory field.

- Submitted By: The name of the user that was logged in when the reviewed file was submitted to IOGC.

- Status: The validity status of the submitted file as a whole. Note that if any line item

in the file is rejected, the status of the file will show as Rejected. This is intended to

provide the user with an obvious indicator that a portion of the file has been rejected

and additional investigation is required to correct the error.

It is not necessary to resubmit the entire file when the error is corrected. However, it is necessary to resubmit all data for a particular royalty entity in order to provide IOGC with a complete statement of data for that entity for the production month. - Original Filename and New Filename: This lists the name of the file that was submitted by the user and the new standardized filename assigned by IOGC.

- Date/Time Received and Date/Time Validated: This provides the system assigned date and time at which the file was received by IOGC as well as the date and time that the file passed through IOGC's validation process. These date/time stamps will be the point of reference should there be a dispute over the timing of a submission.

- Summary of Validation: This summarizes the validation results, including:

Statements Read: The number of statements in the submitted file. A "statement" consists of all data for a royalty entity for a production month.

Statements Accepted: The number of statements that passed validation.

Statements Rejected: The number of statements that were rejected.

Statements Previously Accepted: The number of statements submitted to IOGC with duplicate data already submitted by the Royalty Payor and accepted by IOGC. These statements are accepted, but they do not update IOGC's database. - Submission Results: The validation results for each royalty entity are listed in this section. The message will indicate whether or not a statement was accepted and indicate the range of lines in the file related to the royalty entity. If a statement was rejected, the number of the line containing the error will be displayed, as well as an explanatory message. See the "Trouble Shooting Guide" in this document for explanations of the available error messages and the possible remedies for the error.

- Explanatory Notes: This section includes notes to help the user read the results.

- A "statement" is comprised of all records associated with a royalty entity for a production month. OIL statements typically consist of 1 line. However, GAS statements may have many lines depending on the number of products involved and the number of purchasers to whom GAS sales were made.

- A "line" is an individual record – or line - in a statement.

- Rejection or acceptance of data is at the statement level. So if a single line in a statement is rejected, the entire statement will also be rejected. This is to ensure that IOGC has complete information for all entities. As a result, if a particular statement is rejected, it will be necessary for the Royalty Payor to correct and resubmit the entire statement.

Text description of figure - screen capture of General Announcements menu

This image is a screen capture of the general announcements menu.

General Announcements:

From time to time, IOGC will post general

information to this portion of the website.

Users will be notified when new information

is available.

2.1.5 Enter Gas Royalty Statement

Text description of figure - screen capture of the Enter Gas Royalty Statement menu

This image is a screen capture of the enter gas royalty statement menu.

The screen has areas for entering royalty information, gas details and other product details. More information is included in the text of the manual.

Users have the option of entering GAS royalty data using a simple online form. While this option is available to any user, IOGC anticipates that it will be most useful for Royalty Payors with relatively few royalty entities. Those Royalty Payors with a larger number of royalty entities may find the option of submitting a CSV file more efficient.

Each of the data fields in the online form is described in additional detail below:

Please note that the order of fields for data input is slightly different than for the .csv file for upload, which is described on the following page.

Royalty Information

| Field | Description | Type | Size | Example |

|---|---|---|---|---|

| Royalty Entity ID: | The identification number assigned by IOGC to a well or unit. It must be reported exactly as provided by IOGC or it will be rejected. | Char | 7 | IG01234 |

| Production year | The year associated with the submitted data. This must be a 4 digit number that is equal to or less than the current year | Number | 4 | 2004 |

| Production month | The month of production. The month must be expressed as a number. The month must be equal to or less than the current month (within a valid production year) | Number | 2 | 01 (Jan) 09 (Sep) 11 (Nov) |

| Production entity id | The identification number for the well or unit related to the royalty

entity. If the production entity id does not match IOGC's records for

the royalty entity, the submission will be rejected. Well ID – Must use the DLS format: Province WI [LE LSD SEC TWP RGE MER ES] Unit ID – Format must be: Province UN Unit_Number |

Char | 30 | Well ID: AB WI 123456789123W400 Unit ID: AB UN 0012345 |

| Total gas sales volume | This field is the total of all gas sales for the royalty entity. It is expressed in 103M3. | Number | 12,2 | 1234.56 |

Gas Details

| Field | Description | Type | Size | Example |

|---|---|---|---|---|

| Marketer/Purchaser Id | Applies to GAS only.

This field is a 4 character abbreviation for each company to which

gas sales were made. The current list of valid IDs will be provided at

implementation and an updated list will be made available on IOGC's

website. If sales were made to more than 1 marketer/purchaser, select "Add Line", which will provide additional spaces for data entry. |

Char | 4 | POOL |

| Indian volume available for sale | This field is used to report the volume sold to a particular

marketer/purchaser and is reported in 103M3. Note: The sum of Indian volumes entered must be equal to: Total Gas Sales * Indian percentage. |

Number | 12,2 | 567.78 |

| Reported sales price | The price in $/GJ at which the gas was sold. | Number | 12,6 | 7.891201 |

| Heating value | The heating value of the gas sold. This is expressed in GJ/103m3 with up to 7 decimal places. | Number | 9,7 | 34.5678123 |

| Gross royalty amt | The gross royalty for total GAS sales. To calculate, multiply the total

dollar value of all GAS sales by the royalty percent. If there are 2 GAS transactions for a particular statement, the same gross royalty amount should be reported for both. This is because the gross royalty amount is calculated on the basis of total GAS sales. |

Number | 12,2 | 23456.78 |

Other Product Details

| Field | Description | Type | Size | Example |

|---|---|---|---|---|

| Indian volume available for sale |

For each GAS PRODUCT, report the Indian sales volume for the production month using the appropriate unit of measure (m3 or tones). |

Number | 12,2 | 567.78 |

| Reported sales price |

The price at which the gas product was sold. Prices must be reported as follows: PRO: $/m3 CON: $/m3 BUT: $/m3 ETH: $/m3 PEN: $/m3 SUL: $/tonnes |

Number | 12,6 | 7.891234 |

| Gross royalty amt |

The gross royalty (gross revenue * gross royalty percent) for the product reported. | Number | 12,2 | 23456.78 |

Note: Rejected statements must be re-keyed in their entirety, so it is important to enter the data in the form carefully and accurately.

2.1.6 Upload Gas Royalty Statement File

Text description of figure - screen capture of the Upload Gas Royalty Statement File menu

This image is a screen capture of the upload gas royalty statement file menu. The user can click the browse button to select the csv file name and location. There are three other buttons on the screen, to Submit or to Reset the file, or to Logout.

Users have the option of submitting royalty data in batches using a standardized file format. This makes the submission of data convenient for Royalty Payors with large numbers of royalty entities. In the screen shown to the right, the user will select the "Browse" button and locate the file to be uploaded. Once the file is selected, press "Submit" to send it to IOGC.

Each of the fields in the gas statement file is described in additional detail below:

| Field | Description | Type | Size | Example |

|---|---|---|---|---|

| Royalty Entity ID: | This is the identification number assigned by IOGC to a well or unit. It must be reported exactly as provided by IOGC or the data will be rejected. | Char | 7 | IG01234 |

| Production year | The year associated with the submitted data. This must be a 4 digit number that is equal to or less than the current year (i.e. it is not possible to submit data for future periods) | Number | 4 | 2004 |

| Production month | The month of production. The month must be expressed as a number. The month must be equal to or less than the current month (within a valid production year) | Number | 2 | 01 (Jan) 09 (Sep) 11 (Nov) |

| Product type | The type of gas product being reported. This is a 3 character code, as shown to the right. These are the only product codes that will be accepted by the validation process. | Char | 3 | GAS – Gas PRO – Propane BUT - Butane ETH – Ethane PEN – Pentanes SUL – Sulphur CON - Condensates |

| Production entity ID | The identification number for the well or unit tied to the royalty

entity. If the production entity ID does not match IOGC's records for

the royalty entity, the submission will be rejected. Well ID – Must use the DLS format: Province WI [LE LSD SEC TWP RGE MER ES] Unit ID – Format must be: Province UN Unit_Number |

Char | 30 | Well ID: AB WI 123456789123W400 Unit ID: AB UN 0012345 |

| Total gas sales volume | Applies to GAS only. Leave blank if line is not for GAS This field is the total of all gas sales for the royalty entity. It is expressed in 103M3. | Number | 12,2 | 1234.56 |

| Marketer or purchaser ID | Applies to GAS only. Leave blank if line is not for GAS This is a 4 character code for each company to which gas sales were made. The list of valid IDs will be provided at implementation and updates will be made available on IOGC's website. | Char | 4 | POOL |

| Reported sales price | The price at which the gas or gas product was sold. Prices must be

reported as follows: GAS: $/GJ PRO: $/m3 BUT: $/m3 ETH: $/m3 PEN: $/m3 SUL: $/tonnes CON: $/m3 |

Number | 12,6 | 7.891234 |

| Heating value | Applies to GAS only. Leave blank if line is not for GAS The heating value of the gas sold. This is expressed in GJ/103m3 with up to 7 decimal places. | Number | 9,7 | 34.5678912 |

| Indian volume available for sale | For GAS, this field is used to report the Indian volume sold to a

particular marketer/purchaser and is reported in 103M3. Note: The sum of Indian volumes entered must be equal to: Total Gas Sales * Indian percentage. For GAS PRODUCTS, report the total sales of each product for the production month using the appropriate unit of measure |

Number | 12,2 | 567.78 |

| Gross royalty amt | The gross royalty for the type of product reported. Note that reporting GAS may require more than 1 line in the file, due to multiple purchasers. The gross royalty for GAS should be the total for all GAS transactions. | Number | 12,2 | 23456.78 |

Sample GAS Statement (electronic format)

Each GAS or PRODUCT sale is reported on a separate line. Collectively the following 4 lines make up the statement for IG01234 for the January, 2003.

IG01234,2003,1,CON,AB WI 100123456123W500,,,91.07,,.02,.44

IG01234,2003,1,GAS,AB WI 100123456123W500,5.8,POOL,6.90761,38.33,1.1,87.41

IG01234,2003,1,PEN,AB WI 100123456123W500,,,307.03,,.05,3.67

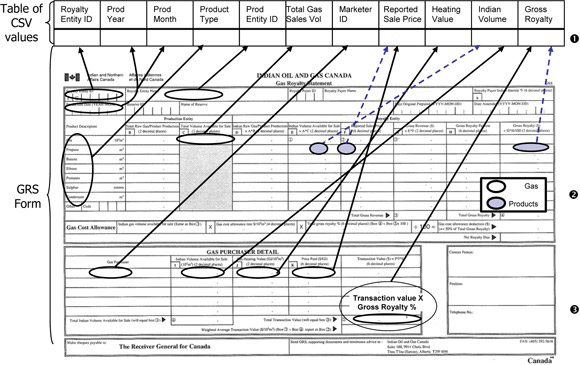

Gas Royalty Statement

The graphic below illustrates where the data from the existing Gas Royalty Statement is to be entered in the standard CSV file:

Text description of figure - graphic of the former Gas Royalty Statement form

This image is a graphic of the former gas royalty statement form, showing where the form data is entered into the csv file. More information on gas royalty statement csv files is included in the text of the manual.

Notes:

- The CSV file will contain a separate line for each GAS sale to a marketer/purchaser and for each type of GAS PRODUCT. To ensure the data is identified correctly, the first 5 cells or values must be repeated for each line in a statement.

- There is some distinction in where PRODUCT and GAS data is located on the GRS form. The differences are indicated according to the legend above.

- he gross royalty amount for each GAS and PRODUCT line must take into account the Royalty Payor's specific Gross Royalty Percentage. Each GAS line should report the same gross royalty amount as it is calculated using the total of all sales.

2.1.7 Enter Oil Royalty Statement

Text description of figure - screen capture of the Oil Royalty Statement menu

This is a screen capture of the oil royalty statement menu. The screen includes fields for entering the royalty entity id, the production month and year, the production entity id, in addition to volume, price, rate and royalty amount. There are three buttons on the screen, to Submit or to Reset the information, or to Logout.

Users have the option of entering Oil royalty data using a simple online form. While this option is available to any user, IOGC anticipates that it will be most useful for Royalty Payors with relatively few royalty entities. Those Royalty Payors with a larger number of royalty entities may find the option of submitting a file of data more efficient.

Each of these data fields is described in additional detail below:

| Field | Description | Type | Size | Example |

|---|---|---|---|---|

| Royalty Entity ID: |

This is the identification number assigned by IOGC to a well or unit. It must be reported exactly as provided by IOGC or the data will be rejected. | Char | 7 | IG01234 |

| Production year | The year associated with the submitted data. This must be a 4 digit number that is equal to or less than the current year (i.e. it is not possible to submit data for future periods) | Number | 4 | 2004 |

| Production month | The month of production. The month must be expressed as a number. The month must be equal to or less than the current month (within a valid production year) | Number | 2 | 01 (Jan) 09 (Sep) |

| Production entity ID | The identification number for the well or unit tied to the royalty entity. If

the production entity id does not match IOGC's records for the royalty

entity, the submission will be rejected. Well ID – Must use the DLS format: Province WI [LE LSD SEC TWP RGE MER ES] Unit ID – Format must be: Province UN Unit_Number |

Char | 30 | Well ID: AB WI 123456789123W400 Unit ID: AB UN 0012345 |

| Total P/E Production Volume |

Oil production for the month. (Note: production = sales for purposes of oil royalties) | Number | 12,2 | 1234.56 |

| Sale price | The price in $/M3 at which the oil was sold. | Number | 12,6 | 43.567837 |

| Claimed Trucking Rate |

This field may only be used by Royalty Payors with pre-authorization to claim royalty deductions for trucking costs. Unauthorized trucking deductions will result in the rejection of the statement. | Number | 12,2 | 12.34 |

| Gross royalty amount |

The gross royalty for the oil sold. | Number | 12,2 | 43.567837 |

2.1.8 Upload Oil Royalty Statement File

Text description of figure - screen capture of the Upload Oil Royalty Statement File menu

This image is a screen capture of the upload oil royalty statement file menu. The user can click the browse button to select the csv file name and location. There are three other buttons on the screen, to Submit or to Reset the file, or to Logout.

Users have the option of submitting royalty data in batches using a standardized file format. This makes the submission of data convenient for Royalty Payors with large numbers of royalty entities. In the screen to the right, select the "Browse" button and locate the file to be uploaded. After selecting the correct file, press "Submit" to send the file to IOGC.

Each of the fields in the oil statement file is described in additional detail below:

| Field | Description | Type | Size | Example |

|---|---|---|---|---|

| Royalty Entity ID: |

This is the identification number assigned by IOGC to a well or unit. It must be reported exactly as provided by IOGC or the data will be rejected. | Char | 7 | IG01234 |

| Production year | The year associated with the submitted data. This must be a 4 digit number that is equal to or less than the current year (i.e. it is not possible to submit data for future periods) | Number | 4 | 2004 |

| Production month | The month of production. The month must be expressed as a number. The month must be equal to or less than the current month (within a valid production year) | Number | 2 | 01 (Jan) 09 (Sep) |

| Production entity ID | The identification number for the well or unit tied to the royalty entity. If

the production entity id does not match IOGC's records for the royalty

entity, the submission will be rejected. Well ID – Must use the DLS format: Province WI [LE LSD SEC TWP RGE MER ES] Unit ID – Format must be: Province UN Unit_Number |

Char | 30 | Well ID: AB WI 123456789123W400 Unit ID: AB UN 0012345 |

| Total P/E Production Volume |

Oil production for the month. (Note: production = sales for purposes of oil royalties) | Number | 12,2 | 1234.56 |

| Sale price | The price at which the oil was sold. | Number | 12,6 | 43.567891 |

| Gross royalty amount |

The gross royalty for the oil sold. | Number | 12,2 | 23456.78 |

| Claimed Trucking Rate |

This field may only be used by Royalty Payors with pre-authorization to claim royalty deductions for trucking costs. Unauthorized trucking deductions will result in the rejection of the statement. | Number | 12,2 | 12.34 |

2.1.9 Sample OIL Statement (electronic format)

In general, an OIL statement for a particular royalty entity will consist of only 1 line, as shown below. It is possible, however, to combine multiple statements into a single file. IO12345,2003,1,AB WI 103123456020W400,389.6,288.6176,13017.02,8.51

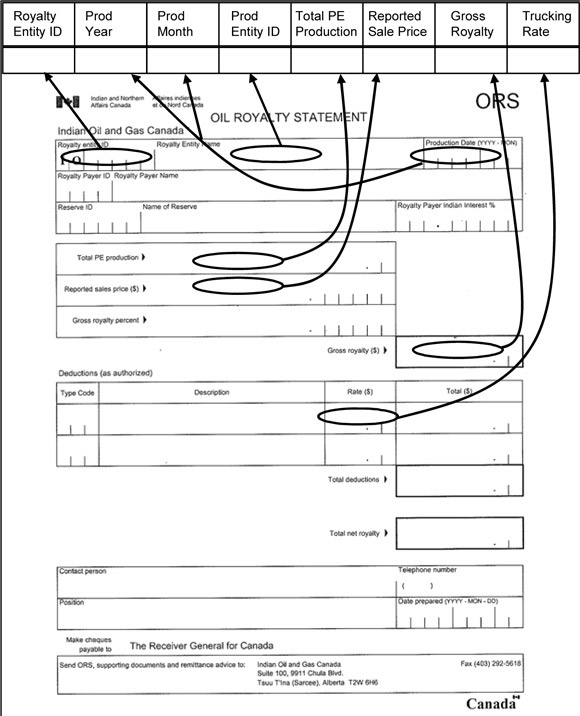

2.1.10 Oil Royalty Statement

The graphic below illustrates where the data from the existing Oil Royalty Statement is to be entered in the standard CSV file:

Text description of figure - data from the existing Oil Royalty Statement is to be entered in the standard CSV file

This image is a graphic of the former oil royalty statement form, showing where the form data is entered into the csv file. More information on oil royalty statement csv files is included in the text of the manual.

2.1.11 Change Password

Text description of figure - screen capture of the Change Password menu

This image is a screen capture of the change password menu. There are three fields on the form to enter the old password, the new password, and to repeat the new password. There are also three buttons on the screen, to Submit or to Reset the information, or to Logout.

Users are responsible for the management of their passwords. To change a password, enter the existing password where indicated. Then enter the new password in both locations indicated and press "Submit".

The Administrator for each Royalty Payor also has the ability to reset a lost or forgotten password.

Password Structure

In compliance with Government of Canada standards, IOGC requires a "strong" password. To comply with these standards, the password must:

- Contain at least 7 characters

- Contain at least 1 upper case letter

- Contain at least 1 number

- Contain at least 1 character that is not a letter, number, comma or quotation mark

Furthermore, if a password is changed, it must be significantly different than the existing password, or it will not be accepted by the system.

2.1.12 Site User Manual (PDF)

This option on the website menu provides a link to the most current version of this document.

Text description of figure - screen capture of the Site User Manual

This image is a screen capture of the title page of the site user manual, entitled Electronic Royalty Data Submission User Manual.

2.2 Administrative Options

The functionality described in this section is available only to each Royalty Payor's administrator.

Each Royalty Payor must designate one user to be the Administrator. This person has the responsibility for adding, deleting and managing the users that have access to the IOGC website on behalf of the Royalty Payor.

Note that the Royalty Payor bears sole responsibility for any data entered under its Royalty Payor ID by a user with a valid username and password. For that reason, the Administrator has a significant responsibility to ensure the Royalty Payor's set of users is maintained and kept current.

2.2.1 Add User

Text description of figure - screen capture of the Site User Manual

This image is a screen capture of the add user menu. There are four fields on the screen, including: enter admin password; enter user id; enter password; and repeat password. There are also three buttons on the screen, to Submit or to Reset the information, or to Logout.

Use this page to add a new user for the Royalty Payor. The suggested format for user IDs is the user's last name and first initial.

Note that the Administrator is responsible to track the User IDs that are created along with the name of the person to which each ID is assigned and any other information the Administrator feels necessary.

2.2.2 Delete User

Text description of figure - screen capture of the Delete User menu

This image is a screen capture of the delete user menu. There are two fields on the screen, including enter admin password and enter user id. There are also three buttons on the screen, to Submit or to Reset the information, or to Logout.

Use this page to delete a User ID from the system. Keeping the list of authorized User IDs up to date will eliminate the potential for erroneous or mischievous use of the system under the Royalty Payor's ID. Note that the Royalty Payor is responsible for any misuse of the system by users created by its designated Administrator.

2.2.3 Change User Password

Text description of figure - screen capture of the Change User Password menu

This image is a screen capture of the change user password menu. There are four fields on the screen, including: enter admin password; enter user id; enter password; and repeat password. There are also three buttons on the screen, to Submit or to Reset the information, or to Logout.

The Administrator for each Royalty Payor is responsible for resetting lost or forgotten passwords. See "Change Password" for a detailed description of the password format requirements.

2.2.4 Update Company Contact Information

Text description of figure - screen capture of the Update Company Contact Information menu

This image is a screen capture of the update company contact information menu. There are eight fields on the screen, including: primary contact name; address; city; province; postal code; phone; fax; and e-mail. There are also three buttons on the screen, to Submit or to Reset the information, or to Logout.

To ensure IOGC has up to date contact information for each Royalty Payor, it is the Administrator's responsibility to maintain the company information. This page will be displayed at the first log in to prompt the Administrator to provide company contact information.

3. Appendix A – Troubleshooting Guide

IOGC validates the data files submitted by Royalty Payors to ensure they contain complete and consistent data. If errors are identified, the file will be rejected and a message returned to the Royalty Payor indicating the nature of the error. The following table lists the messages that Royalty Payors may receive for rejected submissions and provides a brief description of the solution to each error:

| Error Message | Possible Remedy |

|---|---|

| Calculated Marketable Sales Vol does not match total of Marketer Sales Vol. | For GAS only: Ensure the sum of Indian sales volumes (the volume sold to each purchaser) is equal to the Total Gas Sales * Indian Interest Percentage. |

| DLS Production Entity ID is not in a valid format. | Ensure the Production Entity ID is valid and is correctly entered. |

| File Rejected: Not a readable text file. | Ensure that the file is a valid text file |

| Gross Royalty Amount is not a valid number. | Ensure that the Gross Royalty Amount is a valid number |

| Gross Royalty Amount must be equal to or greater than zero. | Ensure that the Gross Royalty Amount is not a negative number |

| Gross Royalty Amount must be less than or equal to 9,999,999,999.99. | Ensure that the Gross Royalty Amount is entered correctly. |

| Gross Royalty Amount truncated to 2 decimal places. | Ensure that the Gross Royalty Amount has only 2 decimal places. This message does not mean that a statement has been rejected, but is an alert that the data has been truncated. |

| Heating Value is not a valid number. | Ensure that the Heating Value is a valid number |

| Heating Value must be equal to or greater than zero. | Ensure that the Heating Value is not a negative number |

| Heating Value must be less than or equal to 99.999999. | Ensure that the Heating Value is entered correctly |

| Heating Value truncated to 7 decimal places. | Ensure that the Heating Value has only 7 decimal places. This message does not mean that a statement has been rejected, but is an alert that the data has been truncated. |

| Indian Interest could not be calculated. | Ensure that the Indian Interest can be calculated for the statement. Contact IOGC for assistance. |

| Indian Sales Volume is not a valid number. | Ensure that the Indian Sales Volume is a valid number |

| Indian Sales Volume must be equal to or greater than zero. | Ensure that the Indian Sales Volume is not a negative number |

| Indian Sales Volume must be less than or equal to 9,999,999,999.99. | Ensure that the Indian Sales Volume is entered correctly. |

| Indian Sales Volume truncated to 2 decimal places. | Ensure that the Indian Sales Volume has only 2 decimal places. This message does not mean that a statement has been rejected, but is an alert that the data has been truncated. |

| Invalid Gas Product Code. | Ensure that the Gas Product Code is one of – GAS, ETH, PRO, BUT, SUL, PEN, CON (all uppercase) |

| Marketer ID does not exist. | Ensure that the Marketer ID exists |

| Missing Mandatory Field: Gross Royalty Amount. | Ensure that the Gross Royalty Amount is entered |

| Missing Mandatory Field: Heating Value. | If Gas Product Code = 'GAS', ensure that the Heating Value is entered |

| Missing Mandatory Field: Indian Sales Volume. | Ensure that the Indian Sales Volume is entered |

| Missing Mandatory Field: Marketer ID. | If Gas Product Code = 'GAS', ensure that the Marketer ID is entered |

| Missing Mandatory Field: Production Entity ID. | Ensure that the Production Entity ID is entered |

| Missing Mandatory Field: Reported Sales Price Amt. | Ensure that the Reported Sales Price Amt is entered |

| Missing Mandatory Field: Total Gas Sales Volume. | Ensure that the Total Gas Sales Volume is entered |

| Production Entity ID does not exist. | Ensure that the Production Entity ID is correctly entered |

| Production Entity ID is not in a valid format. | Ensure that the Production Entity ID starts with either 'AB WI' or 'AB UN' |

| Production Entity ID not in effect for Production Period. | Ensure that the Production Entity ID is in effect for Production Period. Contact IOGC for assistance. |

| Production Month must be a valid number. | Ensure that the Production Month is a valid number |

| Production Month must be between 1 and 12. | Ensure that the Production Month is between 1 and 12 |

| Production Period must be less than current month. | Ensure that the Production Period (the combination of Production Year/Production Month) is prior to the current month |

| Production Volume is not available. | Ensure that the Production volume can be calculated |

| Production Year must be 4 digits in the format YYYY. | Ensure that the Production Year is 4 digits long |

| Production Year must be a valid number in the format YYYY. | Ensure that the Production Year is a valid number |

| Production Year must be greater than 1980. | Ensure that the Production Year entered is greater than 1980 |

| Production Year must be less than or equal to current year. | Ensure that the Production Year is less than or equal to current year. Data for future periods may not be reported. |

| Record Rejected: Invalid record format. | Ensure that each line in the file is a valid comma delimited record with at least 10 commas (GAS) or 7 commas (OIL). |

| Record Rejected: Key fields are not entered. | Ensure that all key fields are entered. Key fields are Royalty Entity ID, Production Year and Production Month. |

| Record Rejected: Unrecognized Royalty Entity type. | Ensure that each Royalty Entity ID starts with IG or IO. |

| Reported Sales Price Amt is not a valid number. | Ensure that the Reported Sales Price Amt is a valid number |

| Reported Sales Price Amt must be equal to or greater than zero. | Ensure that the Reported Sales Price Amt is not a negative number |

| Reported Sales Price Amt must be less than or equal to 99,999.999999. | Ensure that the Reported Sales Price Amt is entered correctly |

| Reported Sales Price Amt truncated to 6 decimal places. | Ensure that the Reported Sales Price Amt has only 6 decimal places. This message does not mean that a statement has been rejected, but is an alert that the data has been truncated. |

| Royalty Entity does not exist for Company. | Ensure that the Royalty Entity ID matches the ID provided by IOGC |

| Royalty Entity ID does not exist. | Ensure that the Royalty Entity ID matches the ID provided by IOGC |

| Royalty Entity ID is not a valid format. | Ensure that the Royalty Entity ID contains 7 characters and matches the ID provided by IOGC |

| Royalty Entity ID not in effect for Production Period. | The Royalty Entity ID must be active for the Production Period. Contact IOGC for assistance. |

| Royalty Entity is not in effect for Company for Production Period. | The Royalty Entity ID / Company ID relationship must be in effect for Production Period. Contact IOGC for assistance. |

| Total Gas Sales Volume is not a valid number. | Ensure that the Total Gas Sales Volume is a valid number |

| Total Gas Sales Volume must be equal to or greater than zero. | Ensure that the Total Gas Sales Volume is not a negative number |

| Total Gas Sales Volume must be less than or equal to 9,999,999,999.99. | Ensure that the Total Gas Sales Volume is correctly entered |

| Total Gas Sales Volume truncated to 2 decimal places. | Ensure that the Total Gas Sales Volume has only 2 decimal places. This message does not mean that a statement has been rejected, but is an alert that the data has been truncated. |

| Trucking deduction is not authorized. Contact IOGC to set up. | For OIL only: Deductions for trucking expenses require prior approval from IOGC. |

| Unit Production Entity ID is not in a valid format. | Ensure the Production Entity ID is valid and is correctly entered. |

4. Appendix B – Marketer/Purchaser Codes

Royalty Payors are required to identify the company to which gas sales have been made. This is currently reported in the Gas Purchaser Statement section of the Gas Royalty Statement.

The Purchaser IDs listed below must be used to report gas sales in files submitted electronically. These are the only IDs that will be accepted by the validation system. If additional purchasers are identified, please email contactIOGC@inac-ainc.gc.ca to request they be added to the list.

| Purchaser Name | Purchaser ID | Description – when to use an ID |

|---|---|---|

| Alberta Reference Price | ABRP | Alberta Natural Gas Reference Price published monthly by the Alberta Department of Energy and used for Alberta royalty purposes |

| ALTAGAS | AGAS | |

| ATCO GAS | ATCO | |

| BP CANADA | BPCA | |

| CARGILL GAS MARKETING | CARG | reserve-dedicated gas sold to the Cargill netback pool which replaced the pools formerly operated by Mirant Canada Energy Marketing Ltd., TransCanada Gas Services and Western Gas Marketing Ltd. |

| CARGILL GAS MARKETING (NON-POOL) | CRGN | non-reserve-dedicated gas sold to Cargill , but not sold to the Cargill netback pool |

| CEG ENERGY | CEGN | |

| CINERGY CANADA | CINE | |

| CNRL MARKETING | CNRL | gas sold to CNRL, not gas produced from CNRL and sold via a CNRL |

| CORAL | CORA | |

| CORAL (ATCO) | CATC | gas sold to Coral Energy Canada at an ATCO receipt point |

| CORAL (NOVA) | CNOV | gas sold to Coral Energy Canada at a TransCanada (Nova) receipt point |

| CORPORATE GAS SUPPLY POOL | POOL | monthly weighted average price for a company's corporate average supply pool |

| CORPORATE GAS SUPPLY POOL (SECONDARY) | POOL1 | same as "POOL" and only used when a company has 2 TransCanada (Nova) receipt points , or for some reason has two distinct pool prices to report in a given month |

| COUNTY OF VERMILION | CTYV | |

| DIRECT ENERGY MARKETING LTD | DEML | |

| DUKE ENERGY | DUKE | |

| ENCANA CORP | ENCA | |

| GIBSON PETROLEUM | GIBS | |

| GLOBAL PETROLEUM MARKETER | GLOB | |

| HOLOKA ENTERPRISES LTD. | HOLO | |

| IMPERIAL OIL RESOURCES | IMPO | |

| KEYSPAN ENERGY CANADA | KEYS | |

| NEXEN MARKETING | NEXM | |

| NOVAGAS | NOVG | |

| PAN ALBERTA GAS | PAN1 | reserve-dedicated gas sold to the Pan Alberta Gas Ltd. netback pool operated by Cargill |

| PRODUCERS | PROD | |

| PROGAS LIMITED | PROG | reserve-dedicated gas sold to the ProGas Limited netback pool |

| SASK ENERGY | SASK | |

| SASKATCHEWAN AVERAGE PRICE | SKAV | Saskatchewan gas for which Saskatchewan Crown royalties are paid and the Saskatchewan "Provincial Average Gas Price" reported |

| SEMINOLE CANADA GAS CO. | SMNL | |

| SUNCOR | SUN | |

| AECO "C"/Nova Inventory | SPOT | An AECO'C'/Nova Inventory Price as published in the Canadian Gas Price Reporter netted back to the field |

| TAIGA | TAIG | |

| TAKE IN KIND | TIK | gas taken in kind by a band-owned company or other entity related to a band for on-reserve use |

| TALISMAN ENERGY INC. | TALI |

5. Appendix C - Terminology

The following terms have taken on a particular meaning in IOGC's implementation of electronic data submissions. For that reason, each term is defined below:

- Statement: All royalty related data for a royalty entity for a given production month. This corresponds to the set of data previously reported on the paper Gas Royalty Statement/Oil Royalty Statement.

- Line: An individual data record in a statement. For OIL, there is generally only 1 line per statement. GAS statements may have more than 1 line depending on the number of products reported for the royalty entity and the number of marketers/purchasers to which GAS sales were made.

- File (or Submission): The full set of submitted data. Files can contain multiple statements (if submitted in a batch CSV). If submitted using the online form, the file will consist of a single statement.

- Royalty Payor: The Company responsible for paying royalties for oil and gas production on First Nations lands.

- Administrator: The person designated by a Royalty Payor to have administrative privileges on IOGC's website application. The Administrator for each Royalty Payor is responsible for creating/deleting users, resetting passwords and ensuring the company contact information for the Royalty Payor is up to date.

- User: The person(s) authorized to access IOGC's website and enter/receive data on behalf of a Royalty Payor.

- Message Centre: The area of IOGC's website where users are able to access the validation status of their submitted files. Royalty Payors are responsible to review the Message Centre after submitting data to ensure all statements have been received, validated and accepted.

- Validation: The comparison of submitted data against certain business rules and IOGC's existing records. This process checks to ensure all required fields are completed and that the data is valid and internally consistent. IOGC's validation process cannot, however, ensure the accuracy of the data. The Royalty Payor bears sole responsibility for the accuracy of the data submitted.

- Resource Information Management System (RIMS): IOGC's royalty management computer system and database.

- Gas Royalty Statement (GRS): The paper forms previously used by Royalty Payors to submit gas royalty data to IOGC

- Oil Royalty Statement (ORS): The paper forms previously used by Royalty Payors to submit oil royalty data to IOGC